Insurance claims have always been a bone of contention for everyone involved. Customers complain about how long the process is, and insurers need to be on the constant lookout for fraud. The million-dollar question is,

In our previous blog post, we talked about how AI can expedite the auto insurance eligibility verification process for insurance companies. Claims verification is expensive and insurance companies need to step up to customers’ expectations while cutting down on costs as well. In this article, we are going to take a look into how AI can help in achieving this by automating the claims process. The video below explains how it is done.

An insurance claim verification process is a comprehensive team effort that is affected by a number of factors like the availability of insurance representatives, the claimant’s preferred body shop, etc. Generally speaking, after the occurrence of a road accident, an insurance representative is sent to assess the damages caused to the vehicle in question. This process usually takes around 5-10 days, depending on the number of representatives available at the time. The vehicle is eventually sent to an automobile repair shop, which will estimate the cost of reparation. The rapid technological advancements in this decade have heightened a customer’s demand for efficient and rapid processing in their insurance claims. Fortunately, Artificial intelligence has made it much easier to meet these expectations. We have developed a solution that can help insurance companies to automate damage estimation and repair cost estimation.

Reach out to us today to know more

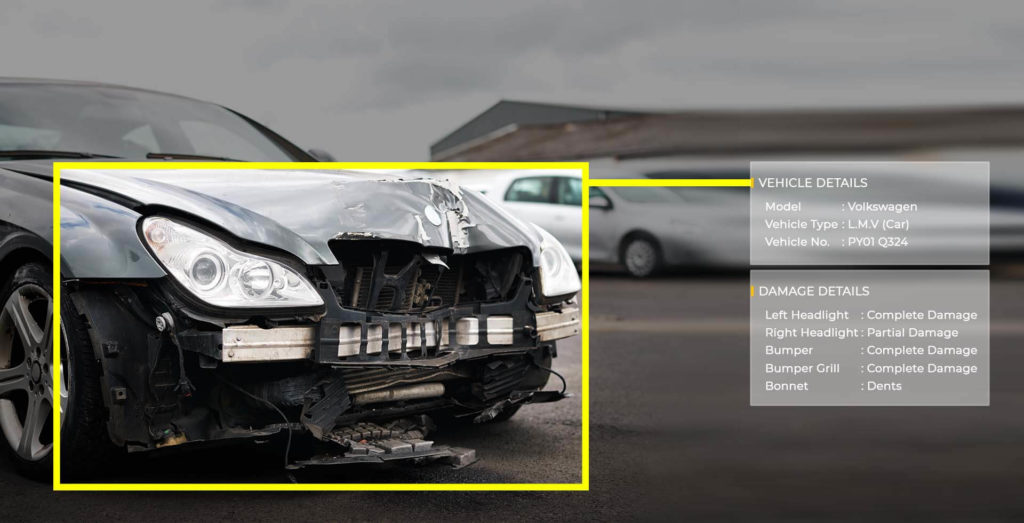

After the occurrence of an accident, an insurance policyholder can simply snap a photo of their damaged vehicle. Using computer vision, the system analyzes the image to identify the make and model of the vehicle, label the automobile parts viewable in the image, recognizes damages such as scratches, dents, breaks, ripped offs, etc.

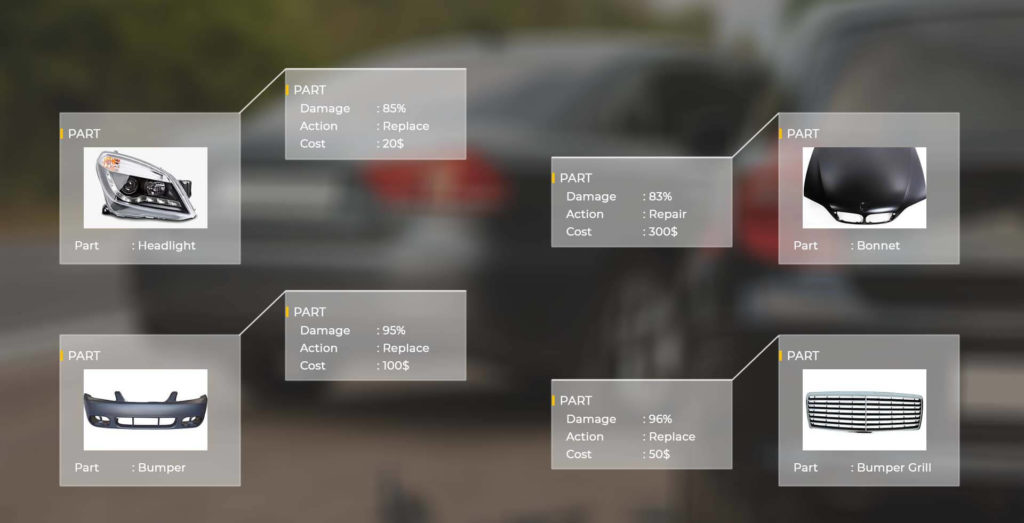

Once the damaged parts are identified, the system further analyzes the damaged parts to estimate the severity of the damage. For this, the system uses KNN AI algorithms to compare the damaged part image with the available stock images or other algorithms.

After analyzing the severity of damage in each section, the system now classifies the damages into different categories such as ‘part to be replaced’, ‘dent removal’, ‘body painting’ etc. The system, which can be integrated with the inventory of the automobile manufacturer can evaluate the estimated cost for repairing the vehicle.

The system uses TensorFlow to to detect damage and predict the severity of the damage.

Reach out to us for a demo

Implementing advanced technology in the claims process can not only provide for seamless and efficient customer experience but also allows for a more accurate and cost-efficient method to analyze the damages caused to a vehicle in a road accident. Insurance representatives will have free time to focus on interacting with customers and providing input to their organizations in a much more valuable manner. Hence, such a solution makes itself advantageous to every party in the claims process.