If you’ve been following the crypto space, I think you probably already heard bits and pieces about NFTs or Non-Fungible tokens. Even though the history of NFTs can be arguably dated back to 2014, this piece of crypto started to gain much popularity in recent years.

Many crypto tokens were introduced to support different applications some of them are namely utility tokens, security/equity tokens, reward tokens, asset tokens, currency tokens and the latest one being Non-Fungible Tokens or NFTs. In this article, we’ll walk you through the basics of NFT. If you are trying to create your own NFT token you can refer this article – How to create an NFT or Non-Fungible Token

Here, we’ll help you gain better insights into NFTs through the below topics:

The word fungible means — easy to exchange/trade for something else of the same type and value. For example, money is a fungible asset. If you lend a $1000 bill to your friend, it doesn’t matter if your friend repays you with two $500 bills or ten $100 bills. As long as the total value of the repaid bills is $1000, you have received the value you lend out.

In another scenario, let’s imagine that you have lent your car to your friend. In this case, you expect your friend to return your car. It will not be acceptable for you if your friend wants to return a different car of the same make and model. That means a car is a non-fungible asset.

Non-fungible assets are unique. For example, a baseball bat usually costs around $200. But, the bat Babe Ruth used to hit his 500th career home run was sold for more than 1 Million USD. There could be thousands of bats that were manufactured in the same batch as this bat, yet, the value of the bat used by babe Ruth is over 1 Million. Because it has a qualitative value attached to it. non-fungible assets hard to trade or exchange with assets of the same type due to their attached qualitative factors like emotions, uniqueness, etc.

No, Bitcoin and other cryptocurrencies like Ethereum, ripple, etc are not non-fungible tokens. Because, for example, if you and your friend trade 1 bitcoin with each other, both of you still have the same value after the trade. That makes bitcoin a fungible token. Bitcoin being a fungible token makes it a good fit for conducting transactions, it can transfer value from point A to point B in a short duration of time. So now it’s time to explore the characteristics of a NFT.

The recent updates in the NFT domain are quite surprising. As NFT tokens are being sold for millions, and images, emojis, etc being auctioned at record value make one wonder, what is happening in this sector.

In simple terms, Non-Fungible Tokens or NFTs are crypto tokens that are unique. Each NFT token will have a unique identification code and metadata that distinguishes it from other NFT tokens.

Remember the example of you lending your car to your friend? Likewise, if you lend an NFT token to your friend, you’d want your friend to repay the same NFT token and not a different NFT token of the same type. Because, as we stated before, each NFT token has its value, derived from qualitative factors and it cannot be traded or exchanged at equivalency.

NFTs are one-of-a-kind. On the other hand, cryptocurrencies like Bitcoin would be considered fungible, as you can trade it for another bitcoin and still have the same thing.

Reach out to us today, to discuss your project

Okay. So now we understand what an NFT is, but, why on earth do we need one? Does it have any business applications?

An NFT can represent the ownership of a wide array of unique assets that can be physical or virtual. This can include collectibles, digital art, rare digital resources, etc. It allows you to buy or sell ownership of unique items and keep track of the owner using blockchain technology.

The relevance of NFT becomes more clear when you think about it from this perspective — Digital files can be easily duplicated. If you see a digital painting, one can just right-click and save the work on their computer. One can even sell it to others because the owner of such works cannot be tracked in the digital world. But, using NFT, artworks, and similar digital assets can be tokenized to create a digital certificate of ownership. Now, even if people replicate the digital asset, the ownership of the original asset remains to one person or entity. This ownership can be bought or sold.

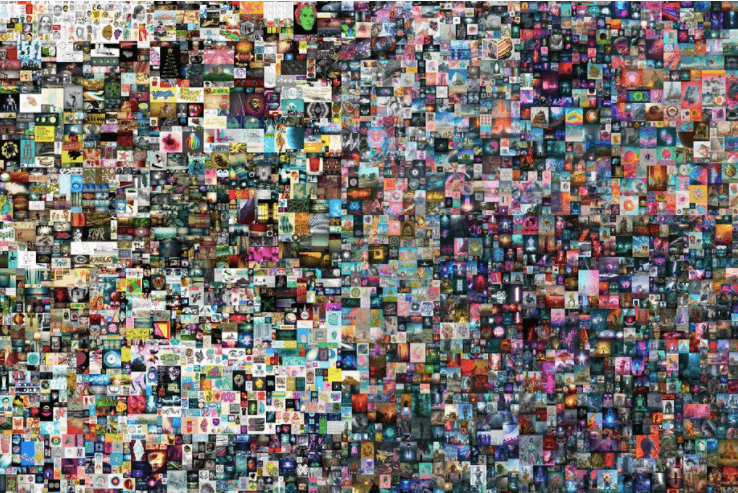

For example, the digital artist, Mike Winkelmann a.k.a Beeple created a series of NFTs for his digital artworks. Last October, he sold the first series of NFTs priced at $66,666.66 each. And recently, one of the NFTs that originally sold for $66,666.66 was resold to a digital asset investor in Singapore for $6.6 million.

Here, the artist’s work, named ‘Everydays – The First 5000 Days’ was linked to an NFT. The ownership of the artwork was transferred to a buyer for $66,666.66. Then the buyer transferred the ownership to a new buyer for $69 Million. As long as the ownership of the specific digital art is properly defined and auditable, fraudsters can’t replicate the artwork and sell it illegally.

Christie's is proud to offer "Everydays – The First 5000 Days" by @beeple as the first purely digital work of art ever offered by a major auction house. Bidding will be open from Feb 25-Mar 11.

Learn more here https://t.co/srx95HCE0o | NFT issued in partnership w/ @makersplaceco pic.twitter.com/zymq2DSjy7

— Christie's (@ChristiesInc) February 16, 2021

There are a wide variety of use cases for NFTs. These applications keep growing as time progresses and we are constantly finding new ways to utilize these tokens. Some of the most commonly used applications can be seen as follows-

NFT tokens can represent game assets like weapons, powerups, vehicles, characters, etc. In micro-economies that emerged within the gaming industry, gamers buy, sell and trade game assets with each other. The common commodities include game accounts with a high rating, in-game collectibles, etc. However, these transactions are prone to fraud as scammers falsely claim to be the owner of an account or a collectible and try to sell it to a buyer. Here, NFTs is the perfect solution, as it can provide authenticity and validation to the gamers for the assets they are purchasing. It also facilitates the open trading of rare game assets. NFTs can be even configured to be burnt or locked up using a cool-down timer until it can be used again.

An Ethereum wallet company, AlphaWallet created a smart contract and sold 2018 World Cup tickets. In another example, OpenSea – an NFT marketplace used NFTs to sell tickets for the NFT-NYC event in 2018 and 2019. Each ticket is a unique ERC-721 item, which OpenSea calls a CryptoTicket. These tickets are instantly re-sellable, transferable, bundle-able, and bid-able. The possibilities of linking event tickets to NFT opens up the opportunities for the event organizer to sell the tickets to global buyers in an auction. Buyers can be sure about the authenticity of the tickets are the ownership of tickets would be easily verifiable in the blockchain network.

Some developers have proposed the creation of NFTs as a means of tracking items to facilitate blockchain supply chain management. The provenance of raw materials, manufacturing details, etc can be recorded in an NFT so that the end-user can easily verify the history of the product they are buying. Nike has patented a methodology to verify the authenticity of sneakers using an NFT system.

NFT can represent individual works of art that have been tokenized and are now represented by a unique token. Ownership of the NFT equals ownership of the underlying work of art. By linking sports cards, collectibles, etc to NFT, it can be easily sold, resell, to a global audience.

NFTs can also be used for digital identification. In 2018, Oxcert became the first project to use ERC-721 KYC tokens to provide an additional security layer for digital identity verification. NFT systems can be used for simpler KYC verifications, where, instead of using paper documents to prove an individual’s identity, a non-fungible token can be used to represent and verify a particular person.

NFT tokens can be used in real-estate, here, the ownership of properties, lands, houses, etc can be recorded in an NFT token. The actual owner of each property can be verified in the NFT blockchain network. The real estate transactions can be potentially simplified to the easiness level in transferring a crypto token. The tokenized properties can be much easier to manage and transfer title ownership.

An NFT typically uses a blockchain to verify its authenticity. This makes it easy to tell the difference between an original and a duplicate token. NFT can come in a variety of different forms, depending on the standard they are built on, e.g. ERC721 and ERC1155 for Ethereum NFT, and TRC721 for TRON ones. Each of these standards has its own benefits and limitations, which can affect the types of NFT that can be created. The vast majority of NFT is currently based on the ERC721 standard.

Marketplaces are an integral aspect of the NFT world. These marketplaces are extremely different from regular cryptocurrency exchanges, which are typically used for fungible coins and tokens. NFT marketplaces often work like e-commerce platforms. Some of the commonly used marketplaces are listed as follows:

OpenSea supports trading for ERC-721 and ERC-1155 tokens, which have been used to create 4 million+ digital items. Gods Unchained Cards, ENS names, CryptoKitties, and Decentraland land are just a few examples of supported NFTs. Since launching in June 2018, OpenSea traders have made 210,000+ transactions.

KnownOrigin is a marketplace for digital artwork. Users can verify each piece on the platform is authentic and truly unique via the platform’s native ERC-721 token, KnownOriginDigitalAsset (KODA). Since launching in February 2018, KnownOrigin has supported 7,500+ purchases and close to 200 artists. KnownOrigin currently has 19,300+ artwork pieces available and 2,300+ editions.

NFT standards are one of the main reasons behind their effectiveness. They ensure that assets will act in a particular way and describe exactly how to interact with the basic functionality of the assets.

ERC721 was the first standard for representing non-fungible digital assets. It is a Solidity smart contract standard, which means that developers are capable of easily creating new ERC721-compliant contracts by importing them from the OpenZeppelin library. This standard provides a mapping of unique identifiers to addresses, which represent the owner of that identifier.

ERC1155, which was developed by the Enjin team, allows for the new concept of semi-fungibility with NFTs. With ERC1155, IDs represent not just one asset but various classes of assets. Essentially, it is a novel token standard that aims to take the best from previous standards to create a fungibility-agnostic and gas-efficient token contract.

In a nutshell, an NFT can represent your identity, qualifications, real-world property, and more. They can be stored, showed, shared, or sold. This allows businesses from all around the world to conduct transactions and manage entire inventories using digital tokens.

Reach out to us today, to discuss your project