Before discussing Algorithmic Stable coins, let’s brush up on our knowledge of stable coins. Anyone who observed the crypto space enough already knows that crypto tokens and coins are highly volatile. Depending on the market conditions, demand, and supply the value of the crypto fluctuates drastically. The high volatility of crypto was a headache for traders, as it could make or break one’s investments.

Stable coins were invented to be a solution for the high volatility of crypto. Essentially, stable coins are a type of cryptocurrency that is not volatile. Meaning, its value does not fluctuate much over time. This is achieved by pegging the crypto to a commodity that is comparatively less volatile. For example, US Dollars. USDT, USBC is stable coins that are pegged to US Dollars. At any point in time, if you hold 1 USDT on your wallet, it means you have a value worth 1 USD on your wallet. Now you are free to trade the Stable coin against any crypto coin without risking huge losses associated with market fluctuations.

So, that’s a bird’s eyes view of a stable coin. If you’d like to learn more about it, you may refer to the article How to create and launch a Stablecoin?

Algorithmic stable coins are invented to solve the same problems that are solved by a normal stable coin, the only difference is the method by which the problem is solved.

Yes, Let’s dig deeper.

You already know that the value of crypto would go up only if more and more people trade it. But, in the current cryptocurrency ecosystem, most of the cryptocurrencies that are listed in exchange lose their value immediately or eventually when people lose interest or stop trusting the projects that they have invested in. To keep people interested in the crypto project, we can explore several reward mechanisms. But, these mechanisms are still not 100% effective. The main reason is that whenever a new cryptocurrency is launched, it competes with another cryptocurrency that was launched 2 days ago, this goes on and on.

Did you find a problem here?

It’s the people! people create the problems in the first place because their minds are in a constant state of chaos betting and bidding on the next cryptocurrency. Obviously, this causes all the fluctuations that you see around in the market because people decide the price and they decide who will perish and who will die out and it is the root cause of this problem. Maybe it’s not a problem, it all comes to the idea of – survival of the fittest.

Like I said before, this high volatility of cryptos can cause migraines for traders. But, thankfully, stable coins turned out to be a perfect solution. But the core idea behind the stable coin is that you need to keep a fund to back it. This is done by backing the cryptocurrencies with a reserve asset such as a US dollar. This is termed collateralization. Now, do you see a new problem?

Reach out to us today and get started!

Most startups that want to launch a stable coin would not have the funds to back it. Of course, they can always go to a VC and ask for money for collateralizing the stable coin. But does that really solve the problem? No right?

The solution we need here is a non-collateralized stable coin or an Algorithmic stable coin. Algorithmic stable coins are crypto stable coins that don’t need fiat backing to be launched into an exchange. This is possible because the price of the algorithmic coins is not controlled by the market conditions or people’s mindset but rather by algorithms.

But how do algorithms control the price of the stable coin?

That’s basically done by controlling the supply of cryptocurrency. If you are familiar with ERC20 smart contracts, you know, every time when you transfer the token from one address to another address the number of tokens associated with the address is updated.

If we can integrate additional minting and burning functionalities into an ERC20 smart contract we can also build an algorithmic stable coin. The updating of the tokens associated with the wallet can be handled by these functions, but that’s not it, there is more.

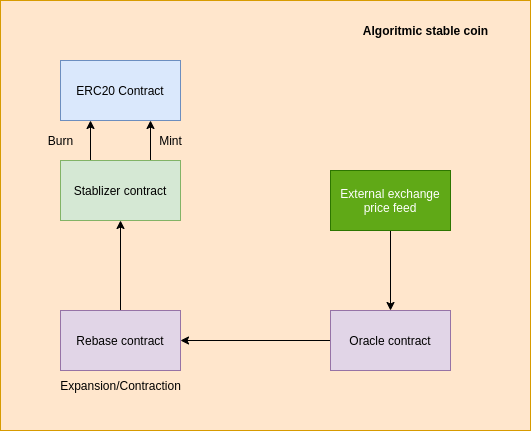

We also require an oracle contract that basically helps the smart contract to communicate outside the blockchain. Oracle contracts help in fetching the price of the algorithmic stable coin from different exchanges. Chainlink is an example of an oracle contract.

Once the price of the stable coin is available it’s passed into a rebase contract periodically every 24 hrs where the contract determines whether the supply needs to be expanded or contracted.

Once the information is available to the stabilizer contract it starts calculating the number of tokens that need to be burned and minted from every user’s wallet associated with the contract and starts the procedure. The basic logic is that if the price of the coin increase from the predefined stable value, the algorithm would start burning the tokens. Likewise, if the price of the token goes below the predefined stable value, the algorithm would start minting new tokens.

Reach out to us today and get started!

There are several algorithmic stable coins out there and many of them are still in the experimental phase. Some of the most popular Algorithmic stablecoins currently in the market include Ampleforth (AMPL), DefiDollar (USDC), Empty Set Dollar (ESD), Frax (FRAX). Algorithmic stablecoins are the true representation of decentralization with no regulatory bodies monitoring the backing of the coin as it is completely managed by algorithms.

Republished from the original article here.