Initial DEX offering or IDO is a new fundraising model that offers better liquidity of crypto assets and faster, open, and fair trading. IDO model is the successor of fundraising models such as ICO, STO, and IEO.

Before we learn about IDO crypto, let’s brush up on our knowledge of the fundraising concept via token sales. If a company wants to raise funds to build new products or expand its business, it has multiple options. The traditional option uses financial loans or investments from banks and VCs.

However, since the success of cryptocurrencies – Bitcoin and Ethereum, more companies have used them to raise funds via token sales. Here companies create crypto tokens and issue them to the general public in exchange for Bitcoin, Ethereum, other major cryptocurrencies, and fiat currencies. This process is called fundraising via token issuance.

There are different methods to do token sales, namely, Initial Coin Offering or ICO, Security Token Offering or STO, Initial Exchange Offering or IEO, and the latest method is Initial Dex Offering or IDO. In this article, we’ll talk about IDO.

If you’d like to read more on ICO, STO, and IEO, you can refer to this article – How to launch an ICO, STO, or IEO

Here, we’ll help you gain better insights into the below topics:

In an Initial Dex Offering, the IDO coin is issued via decentralized liquidity exchanges, such as Uniswap, Bancor, or Binance. Binance DEX hosted the first-ever IDO. According to them, a fundraising method enables protocols available for traders without being controlled by others. An IDO can be self-organized by anyone. So, it does not bear any assurance or guarantee as the issuer controls the event. IDO is gaining popularity as more businesses are considering it for fundraising.

So, what makes it different from earlier fundraising methods in the crypto space?

Initial Exchange Offerings (IEOs) and Initial Dex Offerings are almost identical; we can call IDO the new IEO. In both approaches, the organizations can directly exchange the tokens with individual investors or traders. Compared to an IEO, IDOs are self-organized and decentralized which means that you don’t have to pay an exchange fee as you pay in IEO. Moreover, IDO solves some of the problems in an IEO, such as issuers not being allowed to list tokens with competing exchanges. Issuers must also pay a sizeable token stack or a vast sum to list the token in exchange. Also, issuers are not able to control the parameters of fundraising.

In ICO’s case, the issuers manage all the responsibilities, the same as an initial public offering (IPO) process. In contrast, an IEO, is initiated with the help of a centralized exchange host. When we compare an IDO with the other two, we realize it is a mix of ICO and IEO. The only difference is that IDO replaces the centralized exchange (CEX) with a decentralized one (DEX).

The investment contract in a Security Token Offering (STO) is backed using security tokens. Plus, STO deals with assets that offer monetary profits. STO complies with government regulations, which is yet to be offered in the latter.

If you plan to launch a token offering, consult with a reliable blockchain development company to do a feasibility analysis to check whether your business needs a token offering.

Read more: How to choose the right Blockchain as a Service provider?

An Initial Dex Offering uses the decentralized exchange to facilitate the token sale. A crypto project provides tokens to the DEX, and the users commit their funds through the platform, and then the final distribution and transfer are done by DEX. This automated process occurs through smart contracts on the blockchain.

The rules of the IDO follow standard methods.

They accept a project to run on an IDO after the vetting process, and once they offer a supply of tokens for a fixed price, the users can lock their funds in return for these tokens.

You must complete marketing tasks to join the investor whitelist, or you can provide your wallet address.

To create a proper liquidity pool, some funds are used in the liquidity pool while the rest is given to the team. Investor’s token trade only happens after the TGE, and usually, the liquidity is locked for a certain period.

Read More: Understanding ICO token models. How to choose the best for your project?

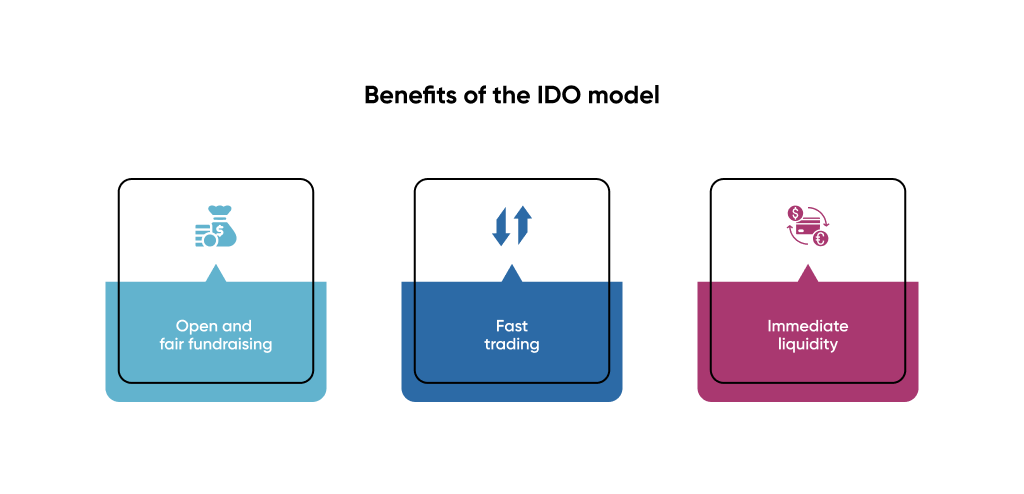

Initial Dex Offerings have many benefits that make them more attractive to crypto investors when compared to ICOs and IEOs. Take a look at some of these benefits.

Usually, it is observed that in the token offerings method, as soon as the token sale goes public, private investors buy a large number of tokens for a lesser price. They will resell these tokens to the general public gaining a huge profit. With the IDO fundraising approach, companies, especially startups, don’t need a centralized exchange and permission to kick off the fundraising event. Also, anyone can organize or participate in IDO, not just private investors.

Another benefit of IDO is that you can trade an IDO coin immediately. This way, investors can buy their tokens quickly when it is launched. And also resell them at a higher price later during the IDO. For example, during the UMA protocol fundraising, the initial token price of $0.26 immediately jumped to around $2.

As per the proper definition, liquidity means the ability to buy or sell easily on the market. Or, in simple terms, how quickly you can get your hands on your cash. Here in the IDO, the project’s token gets access to immediate liquidity, which can benefit the token price.

Read More: Watch out for these common mistakes entrepreneurs make in launching ICOs

According to Binance DEX, the token issuer can organize an IDO crypto issuance independently. Anyone can carry it out either offline with the project’s IT system or online on the blockchain via transactions from the issuer.

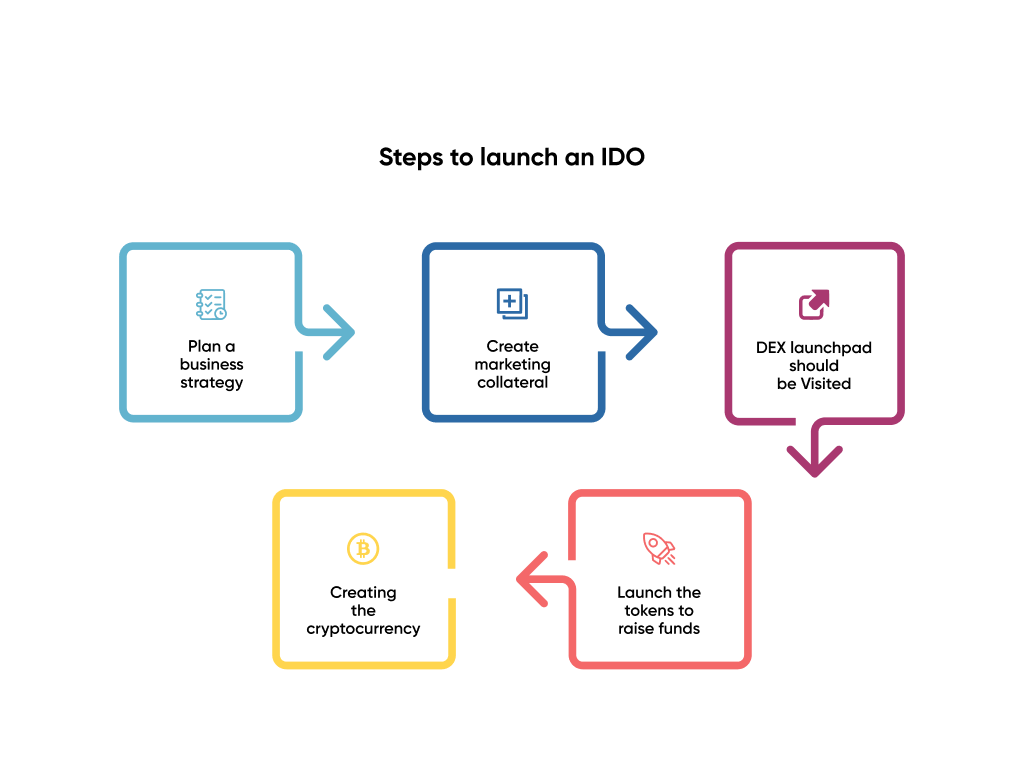

Take a look at the various steps to launch an IDO:

Plan a business strategy

Find a suitable strategy for releasing the token offering over the DEX. The process should include all the issues the project aims to resolve, fund allocation, general marketing strategy, and techniques to maintain momentum.

Create marketing collateral

The marketing collateral of an IDO includes a website and a white paper. A well-developed website can help build investor confidence and make the project appear more professional. Once you have an excellent idea about the website, a significant brand image is established. A white paper, in contrast, is self-educating as it contains statistical data, tables, diagrams, etc. The white paper facts help to persuade the investors to invest.

Approach an IDO launchpad

As soon as the project meets the platform’s requirements involving consensus and whitelisting, your IDO gets approved.

Creating the cryptocurrency

Creating a cryptocurrency doesn’t need much time, as any user with decent marketing and technical skill can launch a crypto coin. Users can also use apps like CoinTool to do all the hard work behind the crypto token launch.

Here, the challenge is convincing investors to invest in the projects by discerning the real-world value and utility. As soon as the token generation event is complete, the DEX lists the token for trading via automated market makers like Sushi swap or Pancake swap.

Launch the tokens to raise funds

The project team generates a token pool where the investors can pay for their tokens in advance to launch a token. Once TGE takes place, the investors receive their token; therefore, instead of setting a fixed price, the issuer can hold an auction and thus achieve a price-driven supply and demand.

Now it’s time to see the issues with this new fundraising model.

Messari, a leading Crypto research firm, says on their Twitter handle that the initial event shows IDO is a reincarnation of Initial Coin Offerings (ICO) and warns average investors to learn how to “avoid getting dumped” by analyzing supply schedules and understanding crowd mentality.

Read More: How to launch a cryptocurrency exchange?

Just like any other investments, given below are some of the points to keep your Initial Dex Offering safe:

Reach out to us today and get started!

As we already discussed, as a brainchild of Binance, the first Initial Dex Offering was on Raven Protocol. The Raven protocol is a distributed and deep-learning training protocol for providing cost-efficient, faster deep neural network training. It was listed on June 17, 2019, and held for 24 hours. A total of 3% of the token supply was assigned, and the value of each Raven token went up to 0.00005 BNB.

Another example of Initial Dex Offering was the UMA protocol, an Ethereum-based platform for issuing and trading synthetic assets. Recently a decentralized autonomous organization, MahaDAO, announced that they would launch IDO for MAHA, their governance token. According to issuers, this token regulates the world’s first non-depreciating cryptocurrency ARTH.

To address the issues in its predecessor’s ICO, STO, and IEO, the crypto community introduced the Initial Dex Offering (IDO) approach. With its decentralized exchange model, where there is no need for permission to organize the fundraising event, it does work to raise funds.

However, at the same time, it leaves loopholes that whales and scammers can exploit, affecting the token issuers with issues like immediate price movement.

Of course, Initial Dex Offering (IDO) is the next step of crypto fundraising. But it needs a lot of work to be done. Like it is important to integrate control mechanisms into the existing IDO model. This can help eliminate variations in token prices until the fundraising has finished. Also, by using KYC regulations, issuers can gain more control over buying tokens.

Kickstart your crypto project by collaborating with our team!

Reach out to us today and get started!

“