Why is blockchain technology celebrated so much? Since its inception, blockchain technology has been a hot topic in almost all tech discussions. Entrepreneurs from all sectors pitched in with their innovations on using blockchain technology to solve different problems in their industry.

Blockchain gave birth to many trends, such as out-of-the-box fundraising mechanisms like ICO, STO, IEO, IDO, and other trends like NFTs, DeFi, and more. In years to come, it won’t be a surprise newer innovations centered on blockchain technology. One element common for all these blockchain-centric innovations is the tokenomics part.

Since the transactions are executed with crypto tokens as the instrument, all blockchain/crypto projects should have a sound tokenomics model. This article will discuss how to design crypto tokenomics for your project.

So let’s start,

Check out our tokenomics calculator

Tokenomics is the short form of token economics. As the name suggests, it defines the economic model of a token. Let’s make it simpler. You’re reading this blog from a country. And you use the central bank or government-issued currency to live in that country. For example, US Dollars, if you are living in the USA.

The government does not blindly print and supply currency into the market. (At least, they are not supposed to do that). The issuance of the currency in the market should be done based on complex math and economic models. For example, the government needs to consider the employment rate, loan rate, GDP, and gazillion other factors in deciding how much currency to issue.

They do this to ensure healthy economic growth. Improper planning can lead to drastic inflation/deflation in the currency value that could greatly impact the country’s economy. If you are launching a crypto project, consider it a country. Now you need to treat the token as the currency used in the country. Tokenomics is the economic model of a token that governs the crypto project.

Designing crypto tokenomics is, as you have guessed already, not a simple task. Even though the economics of a country and a crypto token share the same principles, there is a fundamental difference between them. This difference turns out to be an advantage for the crypto project owner.

The state of the economy in the decentralized digital crypto ecosystem can have a feedback loop. That is, the owner can incentivize users to use particular utility strategies. For example, imagine a citizen spending US dollars on humanitarian activities. There is no active feedback mechanism for the currency issuer to incentivize the citizens to do that specific action repeatedly. It is an open-loop system. But, crypto token models can have the closed-loop model. This state feedback mechanism gives the token issuer the benefit of designing the token model such that the token usage is always increasing. Also, in other words, the token’s value keeps increasing with the increasing demand.

So, let’s have a look at the below steps:

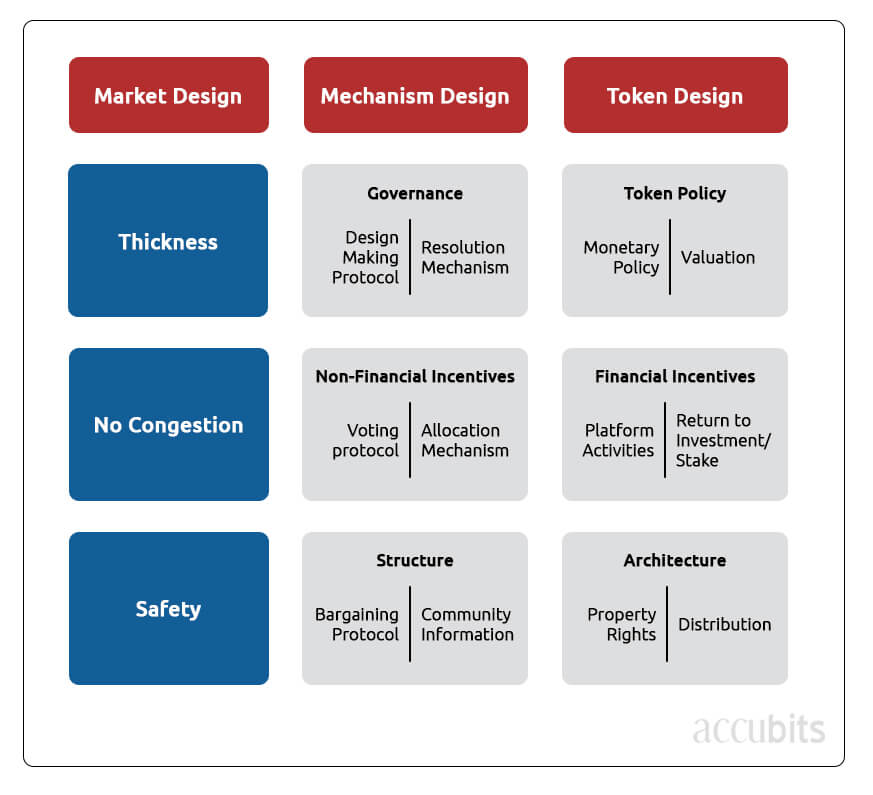

The three fundamental pillars of The Economic Design framework are Market Design, Mechanism Design, and Token Design. Market design is the design of the infrastructure required to conduct trade or transactions. For example, if you launch an app where users can use tokens to pay subscription fees, the app is the infrastructure. Mechanism design is the design of the rules that govern the transactions. For example, only whitelisted users can pay the subscription fees in your app. Token design is the design of the token itself. That is, the instrument the users will use to transact in the market based on the defined transaction mechanisms.

Mechanism design needs to define the governance of the ecosystem, non-financial incentives, and structure of the transactions. how people behave in the ecosystem influence the value of the token. To analyze how people behave in the ecosystem, you need to depend on Game Theory (Out of scope for this blog). The rules you define in mechanism design and token design need to be evaluated with Game theory to see how people would behave in your ecosystem. Your objective here is to trial and error with the rules till the desired outcome is attained. To get those perfect numbers, you’ll have to evaluate your rules and mechanism with matching theory, auction theory, monetary economics, allocation theory, and network economics.

Before starting your token’s design process, you should clearly define the token’s objectives and constraints. There can be many objectives, but you have select one primary objective. This objective is the backbone of the ecosystem. The ecosystem works as a team to meet the objective. All the governance and inventive models should be designed based on this objective. For example, Bitcoin’s objective is to be a decentralized peer-to-peer currency. The governance model of bitcoin is designed to meet this objective. The incentive model – mining reward for the miners is also designed based on the objective. All the participants in the ecosystem are working towards this objective, knowingly or unknowingly.

Constraints are used to limit the scope of the token model. For example, a token model can be made by considering 100 different types of users in the ecosystem or 2 types of users. The more constraints you bring in, the simpler would be the token design process. Constraints can be based on users, jurisdictions, contracts, etc.

The purpose of the token design is to design a system to deliver the objectives, given the constraints.

Once you have defined the token objectives and token constraints, you are good to start with the crypto tokenomics design for your project.

The primary objective of market design is to ensure that the market you are offering is stable and safe so that the users would transact the token within the ecosystem instead of in secondary markets. For example, if you are launching a crypto exchange platform, the platform should ensure asset security for the users. Otherwise, they’ll leave your platform and trade somewhere else. A good market design would always encourage the users to transact within the market or ecosystem, resulting in the increased value of the token ecosystem. A good market design allows trust to develop within the token ecosystem. The best example – Is bitcoin.

As said before, mechanism design is the design of the rules and governance model. These are executed as smart contracts or voting. A good mechanism design is essential for the long-term sustainability of the token model and the ecosystem. In an ecosystem, different types of participants will have different objectives. Your objective is to align the users with rules and incentive models so that no one benefits at the expense of the other. By focusing on the incentives and your assumptions about the ecosystem, you can determine the participants’ behavior. There is no rule or formula to design the mechanism. You can get started by defining the problems you are trying to solve, defining the social goal you want to achieve with the ecosystem, and understanding the constraints.

Check out our tokenomics calculator

Tokens are the incentives of the ecosystem. You can influence participants’ behaviors through the design of the incentive models. IN token design, you need to account for Token policy, Financial Incentives, and Token Architecture. The first step is to define the token policy, which defines how tokens will be governed. It includes the monetary policy and valuation of the tokens.

The monetary policy includes open market operations, discount rates, required reserves, and quantitative easing. The token valuation should be derived from the factors within the ecosystem. Value can be formed via endogenous factors such as value in the token’s design or exogenous factors such as market conditions.

Financial incentives are the best option to take the ecosystem to the masses. As people get financially incentivized to participate in the ecosystem, more people would be interested in joining the ecosystem—for example, Uniswap rewards liquidity providers with UNI tokens for staking tokens in their exchange. The architecture of the token defines the components that constitute the token. Tokens help in the governance of the ecosystem through property rights. It includes claim rights, ownership rights, voting rights, etc. Token distribution defines the token allocation and lock-up of tokens based on pre-defined conditions.

In the previous article, we explored the concepts of designing tokenomics for an ICO project. In the next article, we’ll go through the concepts of curve functions and bonding curves and how they can be used to calculate the token valuation and supply, reserve ratio, etc.

Check out our tokenomics calculator