Loan processing is a lengthy process that involves a ton of paperwork, data checks, and dependencies. The application of RPA or Robotic Process Automation technology in loan processing enables banking institutions to automate several processes. In this article, we’ll explore the scope of loan process automation with RPA.

Simply put, Robotic Process Automation is the technology that substitutes human action for repetitive and redundant tasks by extracting structured data and processing it. Robots are used to mimic human actions based on a set of instructions. They can work with applications much faster than humans with no scope of error. The ‘bots’ can skim through an email or invoice, download files to a predetermined site, copy-paste, and dig through data and file it. It is especially meant for industries that are process-centric.

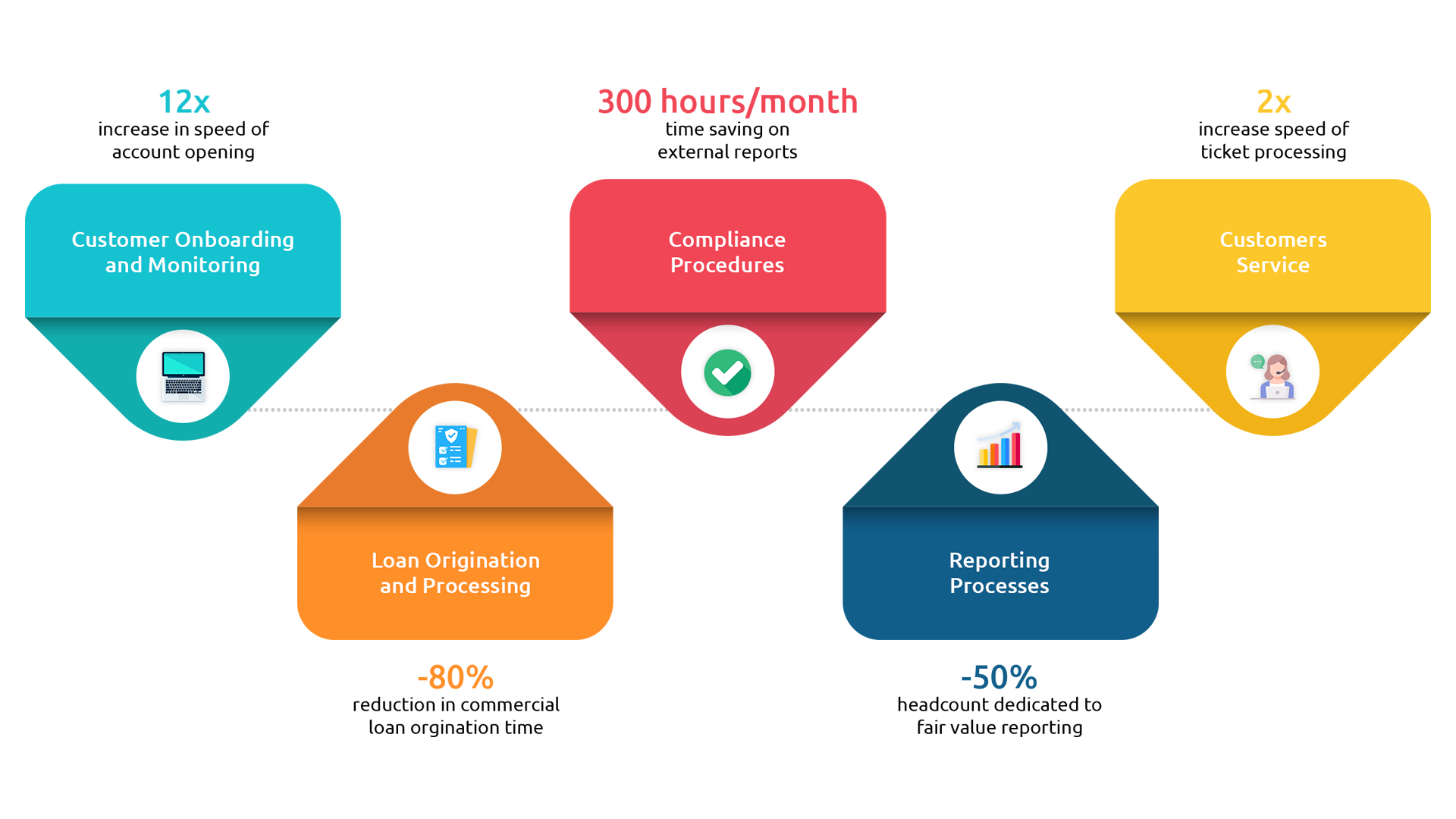

Implementing RPA in loan processing can speed up processes, increase reliability, and reduce labor-intensive tasks, shifting the onus to robots, freeing the workforce to perform more complicated work. RPA in loan processing can fortify the existing mechanisms of banking while also helping the industry scale its growth. According to a study by Mckinsey, a bank optimized its corporate credit assessment using automation, consequently achieving an 80 percent higher productivity. If you want to delve deeper into the definitions and distinctions, refer to this article on What is RPA?.

When it comes to loan processing, customers’ expectations have transformed over the years. In this fast-paced world where everyone is struggling to find enough time, loan processes can be bureaucratic and slow. The lending procedure is intricate and often causes dissatisfaction amongst the customers. It becomes imperative for the industry to cater to the customers’ needs and implement budding technologies to optimize processes. Quick and smooth access to loans will make the task free of hassles where the customers can benefit from streamlined products and services. Automated loan processing can customize the loan process, serving borrowers according to a convenient time, place, and medium. Overcoming these challenges will make lending and borrowing more lucrative resulting in a surge in customer loyalty.

Automation of loan processing can enhance tasks ranging from origination to post-closing. It will make the workflows smoother and more productive. RPA in loan processing can strengthen the workings of the industry in the following ways:

Productivity growth: Automation can quicken a lot of actions like data entry, document routing, task assignments, and email sorting. Eliminating large chunks of time spent on repetitive tasks, automation can greatly increase productivity. Lenders can utilize the lost time in completing other tasks, finishing and processing more applications in a shorter time, and increasing the organization’s profits.

Fraud Detection: There are incidents of increased fraud in the banking industry and it causes colossal monetary losses. RPA can help mitigate losses by early detection of fraud with the help of LOS (Loss Origination Systems) that leverage advanced predictive analytics and gauge how risky it is to lend money to a particular borrower. The organizations can customize the type of loans that are more prone to fraud and use RPA applications in the same.

Reach out to us today for a consultation!

Enhanced Customer Experience: Processing applications of loans is a long and cumbersome affair marred by its bad image. RPA in loan processing has processing can rescue its reputation by providing an improved customer experience. The reduced time taken is a great attraction for customers along with the personalized experience that RPA can deliver. There are reduced chances of inaccuracies compared to manual processes.

Easier Audits: With the aid of RPA in loan processing, documents can be sorted and processes can be swift, making it easier to implement compliance guidelines. This helps ease the auditor’s task by giving easy access to files and operations. Following regulations becomes effortless with the help of RPA.

Predictable Revenue: RPA can forecast the revenue, making it a very lucrative technology. Automation can predict the lead’s revenue generation of the loan over a particular span of the loan cycle. The forecasted revenue aids in dealing with fluctuations in the market and managing government regulations.

RPA can be majorly utilized in commercial banking operations with the help of over-the-desktop automation applications. You can process banking data transcriptions and remove the need for human intervention. Here are a couple of use cases of RPA in loan processing:

Automatic Report Generation: RPA can create reports for compliance that marks fraudulent transactions and generate Suspicious Activity Reports (SAR). RPA can read through compliance documents and sort data in a jiffy when compared to humans.

Onboarding Customers: Manual verification makes customer onboarding a long and cumbersome process making it extremely inconvenient. RPA can extract data from documents and cross-check it against the information provided by the customers.

Mortgage Lending: Loan initiation, processing documents, financial comparisons, are parts of mortgage lending that can be automated making loan approval a faster process. This also increases the customer satisfaction rate.

Loan due report: RPA robots can detect loans that are due soon. RPA can gather files from different branches, combining them and sending them to the needed stakeholders. This can be done at a stipulated time, like 15 days before repayment or scheduled EMI payments.

Balance Register: RPA can be used to check the balance register and figure out the necessary charges that are to be collected. Accounts can be updated automatically to add balances according to the given set of instructions.

Loan Closure NOC: Non-Disclosure Certificates can be produced through automation. The bot receives the documents and the pending loan amount cheque and then goes through the system to see any amount left pending. If found, the process is halted and remarks are updated. Otherwise, the bot proceeds with designing the NOC and sends it to stakeholders for review.

Retail Asset Detail Modification: After receiving documents, RPA bots auto-check the data and if there is a difference in the existing information, it starts the process of updating it to the banking system through a designated person in the bank. If there is no existing savings account and only the loan account, the modification is done by the bot with the intervention of a human approver.

Loan Exposure Sheet: RPA can be used to capture data of social security numbers through the banking system and create a final exposure excel sheet which can be auto-sent to the stakeholders. This will aid in calculating the loan exposure.

SME Credit Management: RPA can manage small credit lines and capital needs of small and medium enterprises (SMEs) with the assistance of robots. The speed of processing is increased through automated credit platforms to facilitate loan applications of SMEs while quickening the approval of applications.

Every industry is waking up to the power of RPA and its ability to revolutionize. Banking is not an exception. To enhance productivity, the banking sector is utilizing automation to offer better, securer, more reliable services. The pandemic has also revealed the cracks which can now be healed by using automation in the loan sector. RPA is the solution to the problem of doing everything virtually and digitally. RPA is assisting organizations to manage competition and incorporating low-cost and high-quality banking methods that benefit the customer are in line with the time’s technology. McKinsey conducted a study that says that in the upcoming years, one-fourth of banking operations will be automated to optimize the services. This proves the scope of RPA in the banking industry.

When it comes to implementation, there are a plethora of ways RPA can be used for loan processing. The organization can sit down and decide on which use cases it wants to focus on by performing a thorough assessment of its functioning. Repetitive and redundant tasks can be easily automated which will also result in higher efficiency. The next step is designing an execution strategy to fit the bill of the organization’s requirements. At any step of the way, you can talk to an expert at Accubits and they will help you in taking the right decision for your business. Then, the only thing that is left is reaping the benefits of Robotic Process Automation.

Reach out to us today for a consultation!