Launching DeFi projects or DeFi tokens can be an extremely challenging task due to the limited information available about decentralized finance. When Bitcoin was launched in 2009, its worth was negligible. However, over the years the popularity of using Bitcoin as a payment method grew exponentially. During this period, other cryptocurrencies began to emerge, the most important of which was Ethereum, launched in 2014, with an initial coin offering (ICO) that raised $18 million. Ethereum brought us one step closer to building a truly decentralized financial ecosystem.

In 2020, the need for such an ecosystem has become greater than ever before. The COVID-19 pandemic has led to a major economic crisis all over the world. Financial systems are being challenged with severe issues that could cause devastating losses to governments, organizations and the general public. In order to combat these problems, several countries have applied monetary policies of quantitative easing, which has led to a decrease in the value of fiat currencies and a loss of public confidence in them. Consequently, the profitability of bank deposits has experienced a major dip as well.

In this scenario, alternative solutions are gaining much more attention. Among them are decentralized finance products: cryptocurrency exchanges, wallets, and lending, trading and deposit services etc. The primary motivators of DeFi adoption include high-interest deposit rates, which can bring holders massive profits in just a few months, and instant loans that can be borrowed with no documents or Know Your Customer verification.

Despite the growing demand for DeFi products, the concept remains a mystery for many. If you are not familiar with DeFi, you can read our article on the introduction to Decentralized Finance.

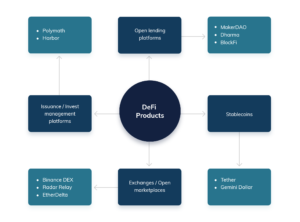

The wide array of products involved in DeFi are also collectively referred to as open finance since it’s an ecosystem where blockchains and digital assets are integrated with conventional financial structures.

DeFi products are characterized by their decentralized nature. They are not managed by an institution and its employees, instead the rules of operation are written in code (or smart contracts). This code is completely transparent on the blockchain for anyone to audit. This leads to a trustless system, where everyone can view the details of the transactions that take place. DeFi products can be used by anyone and are often composed by combining multiple products.

A few commonly used examples of DeFi products include:

To find out more about these DeFi products, you can read our article on popular DeFi products.

Decentralized applications (Dapps) are applications that are built on top of a blockchain network. Dapps can be defined in a variety of ways. However, all decentralized applications will have the following characteristics-

There are multiple issues in legacy applications that DApps try to solve. The main benefit of choosing a DApp over a traditional app is that the latter uses a centralized architecture by storing their data on servers controlled by a single entity. This means they have a single point of failure, which is susceptible to technical problems and malicious attacks.

Although DeFi projects are similar to Dapps, there are some significant qualifiers required for a DeFi project, token or coin. If you are planning to launch a DeFi application, make sure that the following conditions are met:

Reach out to us today and get started!

The application should offer banking or financial services

As technology progresses, there is a chance that many irrelevant Dapps will develop the label of DeFi apps. This would result in an incorrect categorization of the application. A DeFi app should provide services that fall under the financial services sector. This could include services like lending, trading, ETFs etc. Decentralized lending and borrowing has become extremely popular over the past few years. To find out more about it, you can read our article, Decentralized lending and borrowing with DeFi

Include a non-custodial wallet to enable financial transactions

An application that relies on a third-party institution to hold the user’s assets cannot be called a DeFi application. While launching a DeFi application, it is important to ensure that the user will not need to sign-up or give out any personal information. This is why the ability to link non-custodial wallets is a key aspect of DeFi. Noncustodial wallets are platforms that allow users to possess their private keys. These private keys can be used to access funds. The application will either provide a file or will ask users to write down a mnemonic phrase that can consist of 12-24 random words. Non-custodial wallets provide users with the ability to store a cryptocurrency’s private keys and gives the user complete control over their funds. There are usually two types of private keys associated with non-custodial wallets- mnemonic seed and a raw private key.

The app should give users complete control over their assets

Typically, your application will secure all of its transactions through self-executing smart contracts. Users must be provided with a private key that they can use to withdraw their funds. No one else can have access to the assets that are being stored on the application, except for the person with the private key.

No middleman to complete a transaction

Make sure that all the transactions that take place in your DeFi app occur through smart contracts that are completely self-executing. A smart contract is a set of computer code between two or more parties that run on the top of a blockchain and consists of a set of rules which are agreed upon by the involved parties. Upon execution, if these set of pre-defined rules are met, the smart contract executes itself to produce the output. This is why most DeFi apps do not involve any kind of third-party or middlemen in their transactions. If you want to learn more about smart contracts, you can read our article, Smartcontracts in fintech: The possibilities

Try not to include any form of KYC in your application

There are some DeFi applications that require KYC, but these are all regulated apps. Usually, most DeFi apps will not require a sign-up process or any personal details to be provided.

Do not include any minimums to participate in transactions

Usually, there are no minimums to participate in DeFi applications. If there is a minimum, it shouldn’t go beyond 5-10 USD. In many cases, you can earn the same rate in lending, irrespective of how much money you have. Applications like Compound allow you to lend a single Dai, without any minimum.

The services on your app should be accessible from anywhere in the world

The entire point of DeFi is to provide access from anywhere around the world. DeFi apps are designed to be global and users should have access to DeFi services and networks irrespective of their location. However, in some cases this may not be possible due to local regulations.

DeFi wallets allow users to safely store their own funds without the requirement of a third party. They are non-custodial and key-based in nature. MetaMask is a popular DeFi wallet that is primarily used as a web browser extension. MetaMask is the gateway to easily access DeFi through any internet browser. Different plugins can be built directly into MetaMask, allowing it to take on a number of roles across different applications

There are a number of DeFi trading applications that require no KYC, no accounts, and have no trading limits. One such application is Uniswap. Uniswap is a cryptocurrency exchange run entirely on smart contracts, letting you trade popular tokens directly from your wallet. This is different from an exchange like Coinbase, which stores your crypto for you and holds your private keys for safekeeping. Uniswap uses an innovative mechanism known as Automated Market Making to automatically settle trades near the market price. In addition to trading, any user can become a liquidity provider, by supplying crypto to the Uniswap contract and earning a share of the exchange fees. This is called “pooling”.

These refer to a user-friendly layer built over decentralized infrastructures. It gives users improved visibility of the liquidity layers and includes functionalities such as exchange, lending, and other fintech functions. A commonly used DEX aggregator is Totle. Totle is connected to top decentralized exchanges and synthetic asset providers. When you execute a swap through Totle, your order is routed to the sources offering the best prices on the market.

Here, you can hold a basket of two or more crypto assets and they will continue to rebalance, so users can have exposure to multiple crypto assets. The PieDAO platform is a good example of this. It is a decentralized application built atop the Ethereum blockchain, produces its own incarnation of digital tokens called “pies.” They work like tokenized investment funds whose value is linked to a basket of other digital tokens, which in turn are sourced from a decentralized liquidity pool known as Balancer.

DeFi lending and borrowing allows for better security, accountability and transparency in the financial system. To find out more about it, you can read the previous article in the DeFi series, Decentralized lending and borrowing with DeFi. Compound is a blockchain-based borrowing and lending dapp — you can lend your crypto out and earn interest on it. Or maybe you need some money to pay the rent or buy groceries, but your funds are tied up in your crypto investments? You can deposit your crypto to the Compound smart contract as collateral, and borrow against it. The Compound contract automatically matches borrowers and lenders, and adjusts interest rates dynamically based on supply and demand.

Unlike other crypto coins which have a volatile value, stablecoins are blockchain-issued tokens designed to hold on to a specific value. Maker is a stablecoin project where each stablecoin (called DAI) is pegged to the US Dollar and is backed by collateral in the form of crypto. Stablecoins offer the programmability of crypto without the downside of volatility that you see with “traditional” cryptocurrencies like Bitcoin or Ethereum.

If a hacker finds and exploits a bug in the open source code for a dapp, millions of dollars could be drained in an instant. Teams like Nexus Mutual are building decentralized insurance that can cover users in the event of smart contract hacks.

A derivative is a financial contract between two or more parties that derives its value from the performance of an underlying entity. This entity can be an asset, interest rate, or index, as well as bonds, commodities, etc. LedgerX is a clearing house that specializes in cryptocurrency derivatives. LedgerX is registered as a swap execution facility (SEF) and derivatives clearing organization (DCO). Clearing houses like LedgerX provide a level of transparency, predictability, and safety for futures and options contracts that is unavailable in options offered through non-clearing houses. They allow investors to buy or sell cryptocurrency puts and calls, which may help reduce the occurrence of wild fluctuations in cryptocurrency values by allowing investors to bet against the extremes.

Prediction markets are exchange-traded markets created to trade the outcome of events. The market prices can indicate what the crowd thinks the probability of the event is. Augur is a decentralized prediction market protocol. With Augur, you can vote on the outcome of events, except you put ‘skin in the game’ by attaching a value to your vote. Prediction market platforms like Augur and Guesser are nascent, but offer a view into a future where users can make better predictions by tapping into the wisdom of the crowd.

In June 2016, the DAO hack took place, where a hacker managed to transfer one-third of DAO funds to another account by exploiting a vulnerability in its coding. This forced the Ethereum community to hard-fork the blockchain to restore the funds. From this incident, it is evident that there may be a chance for the existence of a bug in the code, which can lead to the draining of funds from the app. In other cases, the funds can get locked up, which means that no one will be able to access them. Some DeFi tools have gone through security audits – for example, Dai has received four security audits so far.

Many DeFi projects have master keys for the developers to shut down or disable dapps or smart contracts. This is done to allow for easy upgrades and provide an emergency shutoff valve in case of buggy code. This can lead to risks, as users will not be completely in control of smart contract execution.

In case a user lends out all of his funds to a DeFi application, they will be unable to withdraw assets because someone else may have already borrowed it.

This refers to a stablecoin that is pegged to USD (like Dai). In case these stablecoins were to fail, people will try to sell them off. This means that they wouldn’t be able to hold the dollar peg. This could lead to severe losses. NuBits is one example of a stablecoin which has failed to maintain its peg.

As with the traditional currency, investors usually use historical data and benchmarks such as the annual inflation of a currency and the risk-free rate of return to evaluate investment opportunities. But in the case of DeFi, the lack of extensive historical data and benchmarks makes it hard to assess the risk of investments in DeFi in a volatile market.

Reach out to us today and get started!