As the paradigm of finance shifts, there are more digitized ways by which you can raise funds for launching or expanding your business. Equity Token Offering (ETO) is a new method by which one can raise funds via tokenizing the company’s assets.

Such a tokenized equity can represent either a share in the company or participation in an investment fund. Government agencies, corporates, startups can use this method to raise funds without going through the hassles of traditional fundraising methods.

According to a report of World Economic Forum (WEF), the tokenization of both intangible and physical properties will propel a significant portion of our future economy, and the market value-add of blockchain will increase to marginally more than $176 billion by 2025 and reach $3.1 trillion by 2030.

In this article, we’ll learn more about ETO and how you can launch it. To help you understand the process let’s look through:

Asset tokenization is the method of converting assets such as bonds, ownership, or investment capital into a digital token. This token is created and maintained on a blockchain. These tokens are regarded as a digital image of a particular tradable commodity.

Related article: How to Digitize Securities, Assets, and Capital Market Instruments using Blockchain.

Tokenizing of assets would increase the investor’s trust in the Security Token Offering (STO) organized for the company’s fundraising. Tokens are often monitored, supplying prospective buyers with investment security and making it much easier to raise funds. Similarly, the shares, assets, and equities of the company can be converted into tokens maintained in smart contracts and blockchains to raise funds.

The advantages over traditional finances can’t be glossed over. Tokenization comes with the benefits of:

Backing the value of a token with a real-world asset can expand the potential investor base of that particular token to a wider market. It brings the possibility of trading on a secondary market. There are a few constraints that exist due to the regulations and yet those can be navigated with help of good legal advice.

Reach out to us today and get started!

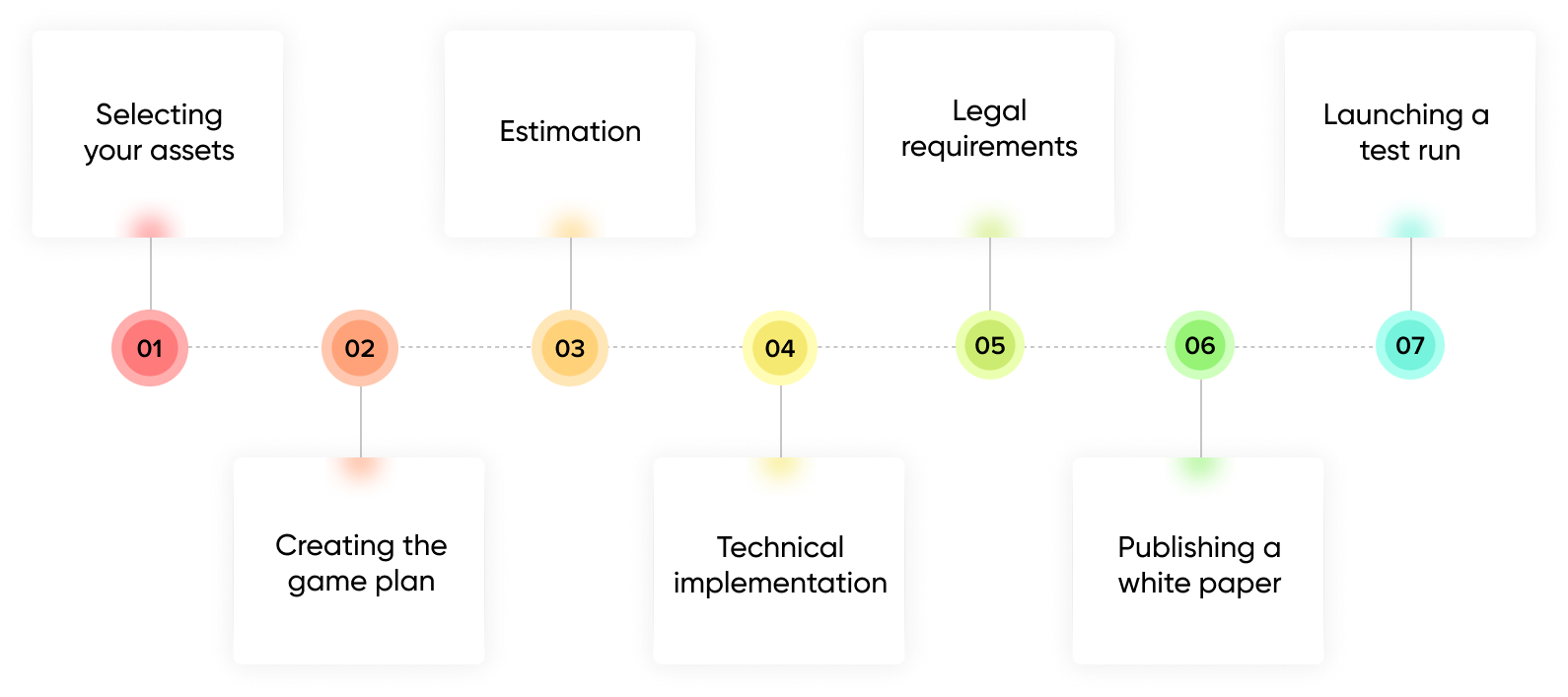

Now that we know the benefits let’s move on to the process of tokenizing your assets.

Hit me up!

Finally when you have tokenized assets and the exchange platform the company is ready to present an Equity Token Offering to its potential investors.

Creating the exchange platform or registering to a platform through Blockchain development companies is the first step. The second is to outline the terms of the contract. This includes specifying the availability of tradable assets or tokens and their value. Once the contract is active it enables the company to create a public listing for the potential investors.

Then the Pre-Equity Token Offering phase presents a set number of tokens to high-worth investors before the offering to the public. Upon placing the offering to the public a maximum fund is obtained and all purchased tokens are released to the investors. After the investment process, a shareholders community is created to keep the investors and shareholders up to date about the company’s activities and information. It includes the voting tools, reporting platforms, and payment methods for the token holders.

ETO and tokenizing seem to be promising a revolutionary financial future. Since ETO promises a transparent, accessible, secure, and affordable method of gathering funds companies benefit from shifting to this mode of fundraising.

If blockchain technology and platforms are what stop you reach out to us for more information and services for the same.

Reach out to us today and get started!