In this second article in the DeFi series, we’ll discuss about decentralized lending and borrowing with DeFi. If you’d like to brush up your understanding of DeFi, check out my previous article that explains what DeFi is, its benefits and some of its products.

Now that we have a basic understanding of DeFi, it is time to look into one of its most important use cases- borrowing and lending. Most of us would be familiar with the traditional methods of borrowing and lending. If a person need to borrow some money to buy a house, their first instinct would be to go to a bank and take out a house loan. However, banks are essentially businesses, they generally charge high rates of interest, which can lead to a great loss of money on the borrower’s side. Additionally, banks may resell your loan to another bank or financing company and this may mean that fees and procedures may change—often with little notice.

Some people may join a credit union. Credit unions offer many of the same services as banks. But they are typically nonprofit enterprises, which helps enable them to lend money at more favorable rates or on more generous terms than commercial financial institutions. However, despite the lower rates of interest, they are unable to provide the variety of loan products that banks do.

Trusting a central authority with your assets and money can be nerve-wracking. This is because they are susceptible to human error, fraud and corruption. Fairly rare, but its a big possibility. There are several occurrences of higher-level bank officials who make human errors and commission loans unethically. For example, take the Yes Bank fiasco.

In 2015, UBS, a global financial services company, raised the first red flag about the bank’s asset quality. The UBS report stated that Yes Bank had loaned more than its net worth to companies that were unlikely to pay back. However, Yes Bank continued to extend loans to several big firms and became the fifth-largest private sector lender This caused a serious deterioration in the financial position of the Bank, and the RBI had to supersede the Yes Bank’s board of directors. They placed the bank under moratorium and capped withdrawals at Rs. 50,000. This decision caused a great deal of inconvenience to all the stakeholders associated with the bank. Such situations have led to serious trust concerns with the traditional method of borrowing and lending money. But what if it was possible to rule out the centralized nature of financial systems?

Peer-to-peer lending solves this problem to a certain extent. Essentially, it is a method of financing that allows individuals to borrow and lend money without the use of an official financial institution as an intermediary. Through peer-to-peer lending, borrowers receive financing from individual investors who are willing to lend their own money for an agreed interest rate. Both parties can connect through a peer-to-peer online platform. Borrowers display their profiles on these sites, where investors can assess them to determine whether they would want to risk extending a loan to that person. But this solution comes with its own set of problems. Firstly, it takes up much more time, energy and effort when compared to traditional banks. It also involves a lot of risk, since there is no fail-proof method of tracking and verifying payments. Additionally, these sites may charge loan origination fees, late fees, and bounced-payment fees. But what if we improve on this peer-to-peer lending concept by using blockchain technology?

Reach out to us today and get started!

The Fintech revolution has provided an opportunity for people to have access to a multitude of financial services, regardless of their financial status or location. DeFi expands on this opportunity by decentralizing the lending and borrowing process. This leads to better security, accountability and transparency in the financial system. According to research conducted by Messari, DeFi lending is the top-performing category in terms of ROI, followed by decentralized exchanges and DeFi payments.

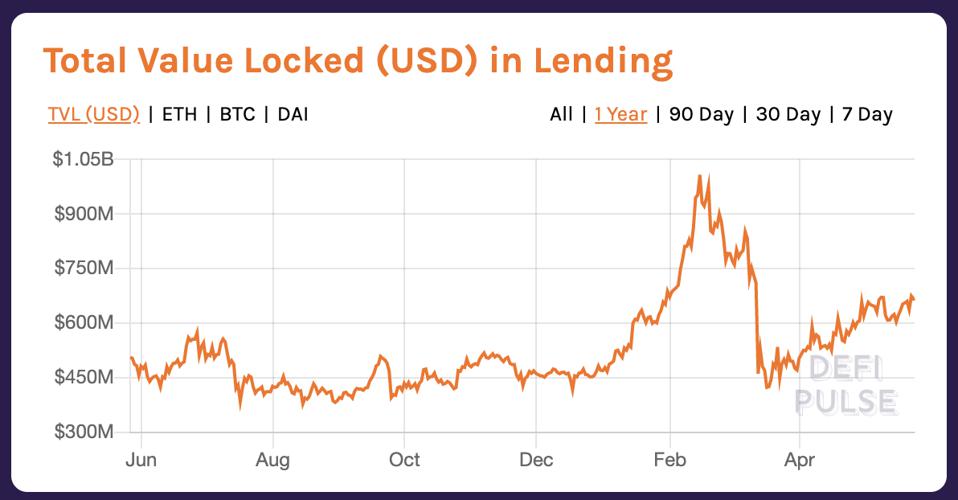

Total U.S. dollar value locked in DeFi lending protocols increased 75% in the past year. HTTPS://DEFIPULSE.COM/

Total U.S. dollar value locked in DeFi lending protocols increased 75% in the past year. HTTPS://DEFIPULSE.COM/

Let’s take a look at how it works-

Now that we have discussed decentralized lending, let’s take a closer look at the borrowing process. Similar to the lending process, decentralized borrowing is extremely secure.

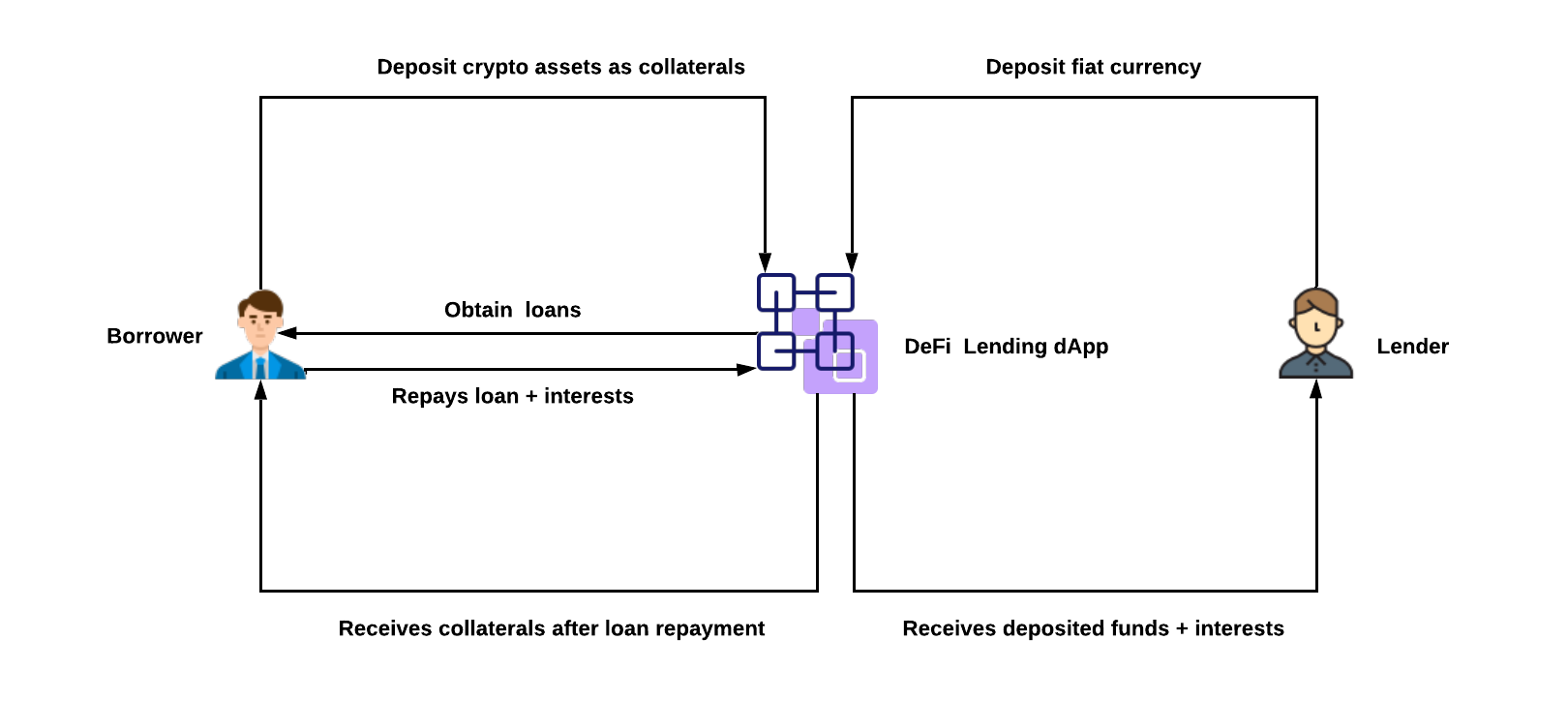

The typical process involved is as follows-

The follwing are a few basic characteristics of a DeFi app. However, these are not strict defining factors for a DeFi dApp as many of the existing DeFi apps in the market do not all of there characteristics.

DeFi lending and borrowing platforms allow users to deposit and lock their funds into smart contracts, from where other users can borrow and pay interest on them. Each loan is collateralized by crypto. Let’s take a look at some of the popular DeFi platforms being used today-

Compound

Compound is an open-source and decentralized protocol allowing users to earn interest on Ethereum digital assets by lending them for acquiring real-world assets like real estate, vehicles, or commodities.

Here’s how Compound works:

Reach out to us today and get started!

Aave

Aave is an open-source protocol that uses a pool strategy to adjust the interest rates algorithmically. Some of the unique features that can be seen on this platform are-

The ecosystem has its aTokens for paying interest and LEND tokens granting voting rights for decisions related to the protocol parameters and smart contract upgrades.

Nuo Network

Nuo Network is a decentralized debt marketplace that connects lenders and borrowers across the world using smart contracts. There is no native token and the interest rates are adjusted algorithmically.

MakerDAO

MakerDAO is a decentralized protocol that is made up of a smart contract service that manages borrowing and lending, as well as two currencies: DAI and MKR to regulate the value of loans. On MakerDAO, there are no lenders, and the only asset available to borrow is DAI.

Reach out to us today and get started!

These decentralized platforms offer several benefits like added security, transparency & accountability with no requirement of credit checks. This makes them a very attractive option. However, most of them involve the use of cryptocurrency, which can be a challenge for people who are not familiar with it. That being said, decentralized lending and borrowing with DeFi is evidently much more effective than the traditional practices that many of us use today.