A wave of disruption is rising in the finance sector as open banking initiatives are gaining momentum in different markets. About 25 million people are using open banking services as of 2020 and this number is projected to reach over 132 million by 2024. With up to 416 billion revenue at stake, the time is ticking for banks to go beyond traditional banking and join the bandwagon of fintech to ride out the damage.

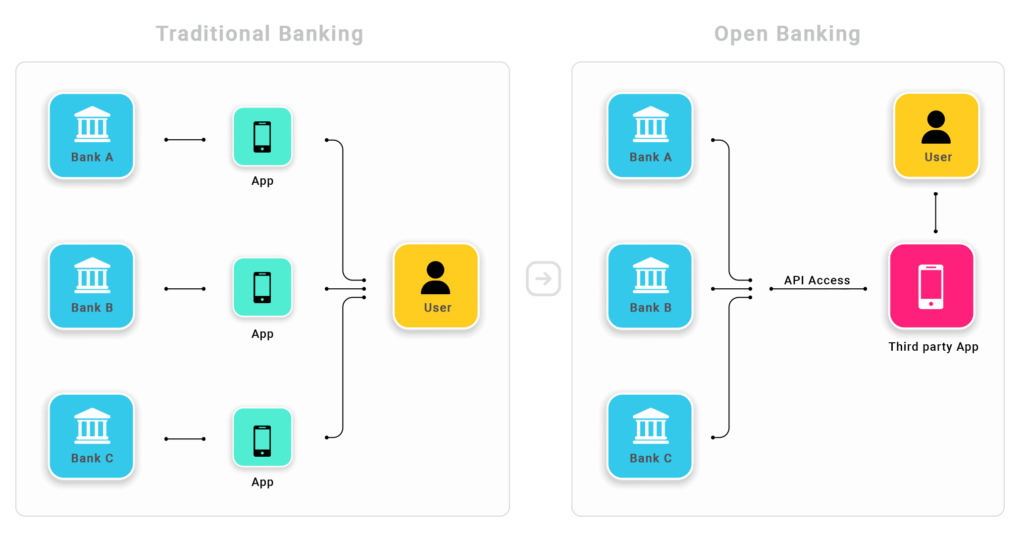

In simple words, open banking is a banking practice that allows third-party financial service providers open access to consumer banking, transaction, and other financial data from banks and non-bank financial institutions through the use of APIs.

Why provide access to third parties?

By allowing third-party companies to access consumer banking data, banks can deliver better service to their customers. In the traditional scenario, the customer would have to depend on the bank’s e-banking app, net banking, etc to do financial transactions. But with the introduction of open banking, customers can do the transactions from their favorite third-party app that offers better convenience. The benefits for the customers are

Open banking allows a higher level of customization and personalized services as the API can also analyze customer transaction data to recommend the best financial goods and services for them, such as new savings account with a better interest rate than their current savings account or a different credit card with a lower interest rate.

That looks like a lot of benefits for the customers. But, what’s in it for the banks? Turns out, open banking can be beneficial for banks in a lot of ways. In fact, according to a study conducted by Open Data Institute and PwC, open banking can create a £7.2bn revenue opportunity for banking institutions by 2022. The key benefits for banks are:

To understand that let’s have a look at some of the basics:

Since open banking is offering a lot of benefits for both customers and banks, the obvious choice is to get started with it. But,

What is limiting banks from embracing open banking faster?

The answer is – security concerns. 48% of retail banking customers and 54% of SMEs state that banking security is their biggest concern with open banking. Is it not safe?

Of course, like any other banking application, open banking infrastructure needs to go through rigorous security testing before it can be made live. The short answer is that open banking is perfectly safe. Numerous banks worldwide have embraced open banking and customers are celebrating it. If done right, it can offer a smooth stepping stone for banks to embrace the future of banking.

Yet, the reality still remains that some third-party companies access financial data through insecure methods. Through processes like screen scraping, companies can log into financial apps and collect customer data without their consent. But with the increased adoption of open banking, banks have an upper hand at regulating the collected information and ensuring that the collected data is secure and not misused.

Related article on Innovation in Fintech

Traditional banking services are known for a collection of things like poor customer experience, tedious procedures, and even hidden or extra fees. Open banking counters all of that as it allows for excellent client service, easy user interfaces, ease in procedures depending on the service, and above all, affordability.

Traditional banks must face the challenges of providing these services all the while adapting to the technical innovations. But APIs can assist banks in fulfilling their traditional role of trusted advisor all the while providing additional services like problem-solving ability in areas like identification, compliance, categorization, design, and client support. Beyond this, it provides unmatched speed in the decision-making process.

Throughout the world, open banking was implemented through different structures by different governments. A few of these are listed below:

CDR in Australia

The Consumer Data Rights (CDR) was implemented by the Australian Government in November 2017. The motive is to provide the consumers better access and control over their data. This in turn increases the consumer’s ability to switch between services and products by providing sufficient information to compare between them and make a choice. By encouraging competition between the service providers, it brings in better customer experiences and better innovations in the respective fields.

CDR operates under regulations of the Australian Competition and Consumer Commission (ACCC). Banks can share financial data with third-party companies that are accredited by ACCC. The consumer has the right to share their information with other banks or financial institutions. Control over the usage and sharing of the data lies with the individuals, the data is protected by the rules set by ACCC.

OBGW in the UK

The Open Banking Standard is a UK project set up in 2015 by the Open Banking Working Group (OBWG). Its aim is to research how financial information accessibility may assist clients to understand their accounts and thus make informed choices about their finances. The Open Banking Standard depends on information being securely shared through open APIs, which would permit outsider applications, for example, fintech organizations, to get clients’ data by accessing their balances.

The OBWG believes that the Open Banking Standard would usher in a new era of banking innovation that would benefit users, developers, and banks. It would help developers as simple access to data would allow them to simplify existing applications, making them faster and easier to use, along with building new apps to meet the ever-changing demands of users.

The Standard goes past the API Specifications to incorporate Customer Experience Guidelines and Operational Guidelines. The Standard is available to all record suppliers (ASPSPs) and has been executed across 90% of the UK installments account market. It empowers a well-working, effective environment without obstructions by TPP services and provision of products.

UPI in India

In India with the increasing usage of mobile payments and digital transactions, a cheaper and easier mode of payment was essential. Unified Payment Interface(UPI) governed with the regulations set by RBI made open banking a possibility in India. With UPI, an individual can choose any application to make payments from his account and is not restricted to the banking app interface.

For fintech firms to operate and access data, they must either obtain a special payment bank license or be linked to a financial institution with a banking license. Either way, the firms would come under a payment system with predefined regulations. This allows the RBI to ensure security and stability of the system all the while fostering financial inclusion.

By allowing banks and third-party developers to work together the community stands to gain a lot. It can help ease in comparing account services and thus help make an easier and well-informed decision about the prices or about the required documents across banks. It can also help individuals with personal budgets and financial history.

If third-party apps are allowed access to the credit details of the customers then it paves the way for personalized loan offers based on affordable rates. This frees up the burden of relying solely on banks. And moreover can speed up the process of checking affordability with minimal paperwork. Moreover, Fraud detections can provide specialized attention to threats across accounts.

Banks and financial service suppliers in Europe and the UK are testing beta versions of their new operating models, and some of them have made amazing progress by creating entire sets of open banking solutions, especially in regards to Application Program Interfaces (APIs). But the regulations surrounding them are an important part as well.

Throughout different countries, different policy initiatives across jurisdictions have emerged to try to make open banking a reality. Many things must be taken into account like which entities these regulations apply to, is it just banks, or other types of financial entities; what information should be accessible by third parties, with the customer’s consent, such as transactional information, product data, or aggregated statistics; and whether operations, like account-to-account payments or contracting new products, are included.

Related article on Regulations on Fintech

Just as importantly for many third parties, the initiatives also have different approaches to standardization, like the degree to which data formats, security rules (like customer authentication), API frameworks, and elements of the user experience are common across entities. Standardization makes life easier for third parties and can ensure minimum requirements are met, but also risks increasing costs and reducing flexibility.

These are some of the initiatives with different approaches:

Europe: In Europe, the revised Payment Services Directive (PSD2), applies to banks and e-money providers and facilitates access for third parties to both transactional data and to payment operations. Banks can choose whether to develop APIs which, although not standardized, must be approved by authorities. Industry groups such as The Berlin Group have developed their own API standards to support implementation.

Outside Europe, there are two main categories of initiatives that are emerging: market-driven and regulatory-driven

Countries like India, Japan, Singapore, and South Korea don’t have formal or compulsory Open Banking regulations, but their policymakers are introducing a range of measures to promote it and lay a framework for open banking.

For example, In Singapore: MAS and The Association of Banks have published an API Playbook to support data exchange and communication between banks and FinTechs.

In Japan: the FSA has established an authorization process for TPPs, introduced an obligation for banks to publish their Open APIs policies, and encouraged banks to contract with at least one TPP by 2020.

The US has also opted for a market-led approach. But without a structure for implementation, government initiatives to support the development of Open Banking products and services are at crossroads. The major US banks are well aware of the strategic importance of Open Banking. However, in the absence of an industry-wide API strategy, the intuitive will have a difficult time being established smoothly.

Outside the EU, two major jurisdictions have opted for a regulatory-driven approach: Hong Kong and Australia.

Hong Kong: The Hong Kong Monetary Authority issued an Open API Framework in July 2018, setting out a four-phase approach for banks to implement Open APIs, starting with information sharing on products and services, and ending with sharing of transactional information and payments initiation services. Contrary to the EU approach, however, while banks will be required to develop APIs, they will be able to restrict access to those TPPs with which they choose to collaborate.

Australia: The Consumer Data Right in Australia applies only to banks (although eventually will also include other sectors of the economy, such as energy and telecoms). It includes transactional and product data across a wide range of product types, with standardized APIs. The key difference however is that the CDR is a data policy initiative and not a financial services one.

BBVA: In 2018, BBVA launched its BaaS platform, Open Platform, in the US. Open Platform utilizes APIs that allow third parties to offer customers financial products without needing to provide a full suite of banking services.

HSBC: HSBC launched its Connected Money app in May 2018 in response to the UK’s open banking regulations that attempt to place control over financial data into the hands of consumers. Connected Money allows customers to view various bank accounts as well as loans, bills, and credit cards, in one place.

Barclays: Barclays claims to be the first UK bank to enable account aggregation inside its mobile banking app. Its open banking feature allows customers to view their accounts with other banks within Barclays’ mobile app.

Kotak: Kotak Mahindra Bank announced the launch of its open banking platform in November 2018. The platform is powered by a developer portal which makes Kotak’s APIs available to FinTechs and developers, thereby creating a collaborative ecosystem. With this, customers benefit from better financial services which are catered to their specific needs. FinTechs and developers have to register their details on the portal before gaining access to the APIs. The initiative has been a part of Kotak’s digital-first organic growth strategy that was planned to be driven by its ABCD charter that focuses on the AI-enriched app, biometric-enabled branch, context enhanced customer experience and data empowered design.

HDFC: The HDFC Bank Public API Portal has 142 APIs as of now in its catalog. The bank aims to securely expose APIs to developers while providing them with all the tools and resources they need to quickly build apps. In December 2019, the 1st edition of the HDFC Bank API Banking Summit was held to apprise the delivery of HDFC Bank’s internal services via the API gateway to external partners such as corporates, FinTechs, aggregators, and start-ups.

In conclusion, the trend of open banking has major implications when it comes to customer services, ease of use and it plays a part in uplifting the financial world through the involvement of both the fintech and banking industries.

Reach out to us today to schedule a call with our experts.