DeFi is a familiar term in the crypto world, and it summarises the whole concept of the same. DeFi (Decentralised Finance) is a protocol, and it differs from traditional financial services in the fact that DeFi does not require any intermediaries to carry out a transaction. The blockchain technology in DeFi cuts out banks and other intermediaries, including brokers, stock exchanges, and such. We witnessed DeFi go from a small idea to a colossal business like it is today. Now, DeFi 2.0 is all about improvement and an ambitious drive towards new protocols that make the next phase of crypto.

In this article, we will help you gain better insight into what is a DeFi 2.0, why does it matter, and what are the various use cases of DeFi 2.0.

Let’s walk through into some of the basics:

DeFi 2.0 is a collection of projects aimed at improving the issues in DeFi 1.0. Problems of scalability, security, liquidity, and accessibility of information are a few sets of things being considered. Once implemented, 2.0 can encourage more people to use crypto and understand the advantages of decentralization.

DeFi 2.0 did not essentially start at a particular time. As the world kept stumbling upon the limitations of DeFi 1.0, solutions developed for those came to be known as 2.0. The risk of impermanent loss, not having insurance backup, high traffic, and low transaction rates paved the way for innovations.

Yield farming has become a household name in DeFi across all activities. Yield farming will help generate a digital asset return or yield, usually calculated in APY. Reinvesting returns is the whole concept behind the term “farming.”

Read more: How to build a DeFi yield farming dApp?

The assets we lend to a DeFi platform provide the platform’s liquidity, and you are offered all the classic DeFi benefits like collateralized borrowing and token trading. As DeFi becomes more prosperous, enhanced protocols provide greater rewards to earn more liquidity. One negative result of this protocol is that it is unsustainable, and the platforms eventually run out of rewards to give. A contract did not bind the liquidity providers of the platforms, and they could cash out anytime they wanted, which was usually when the rewards dried up. When whales (who hold over 1 million dollars worth of crypto) cash out, it drains the protocol’s liquidity considerably, and its native token crashes.

On June 16, 2021, Titan’s token traded at a decent 65 dollars per token. On the evening of the same day, whales began dumping their tokens one after the other, and the next day, the price dropped to 0.0000024 dollars, and even Mark Cuban faced the consequences of this. Specific platforms developed an innovative way to fix this, widely praised as a nod to decentralized finance 2.0. Olympus is a platform that uses the decentralized finance 2.0 protocol to solve this particular issue. Instead of using decentralized finance 1.0’s liquidity mining incentives, Olympus uses a concept called Protocol-Controlled Liquidity (PCL) that prevents destructive moves by whales. Eventually, PCL could become the decentralized finance 2.0 standard.

DeFi in 2020 had a huge obstacle of a consistent lack of long-term sustainable liquidity. DeFi platforms had been gaining liquidity by incentivizing it with systems like liquidity mining. Liquidity mining involves third parties to whom you lend tokens in exchange for an incentive. Staking or lending your crypto assets to a DeFi platform will enable you to receive some of the platform’s native tokens, and that is a liquidity mining incentive.

DEXs is a brilliant development in DeFi 1.0. DEX platforms like Uniswap and Pancakeswap allow you to create your liquidity pools or contribute to a pool in exchange for a share of the transaction fee.

Read more: Things to know before launching for your auto yield farming project

One of the complaints of DeFi is the lack of genuine decentralization. As DeFi grows in popularity, more protocols move to a DAO operating structure. DAOs are managed and owned by the community of users with no interference from a centralized authority. Anyone who holds a certain quantity of the DAO’s governance token has voting rights over the changes in the protocol. MakerDAO, Uniswap, and Olympus are a few DAO users, but still, a large section of platforms have yet to adopt this.

Read more: Should you consider HECO blockchain for your DeFi projects?

The total value placed on DeFi protocols is the 250 billion dollar mark, and the global market cap for all the DeFi tokens is now nearing 150 billion dollars. The estimated global derivatives market for DeFi is one quadrillion dollars. With this, we know that DeFi still has a long way to go before it can get any close to traditional finance.

Still, DeFi 1.0 we have today has an impressive set of financial services. For example, the MakerDAO enables you to use crypto as collateral against stable coins and other less volatile assets. Derivatives platforms like Synthetix allow you to create synthetic tokenized assets that mimic an existing investment. This allows for the creation of indexes like the crypto index. But to appeal to a greater mass, DeFi has to go deeper than superficial decentralization.

DeFi platforms leave no individual responsible for security breaches, so there is little chance of tracking the wrongdoer or getting the lost money back. Some of the loopholes in previously developed contracts have cost millions for holders, and decentalized finance 2.0 is a movement to improve upon those.

Reach out to us today for a no-obligation consultation

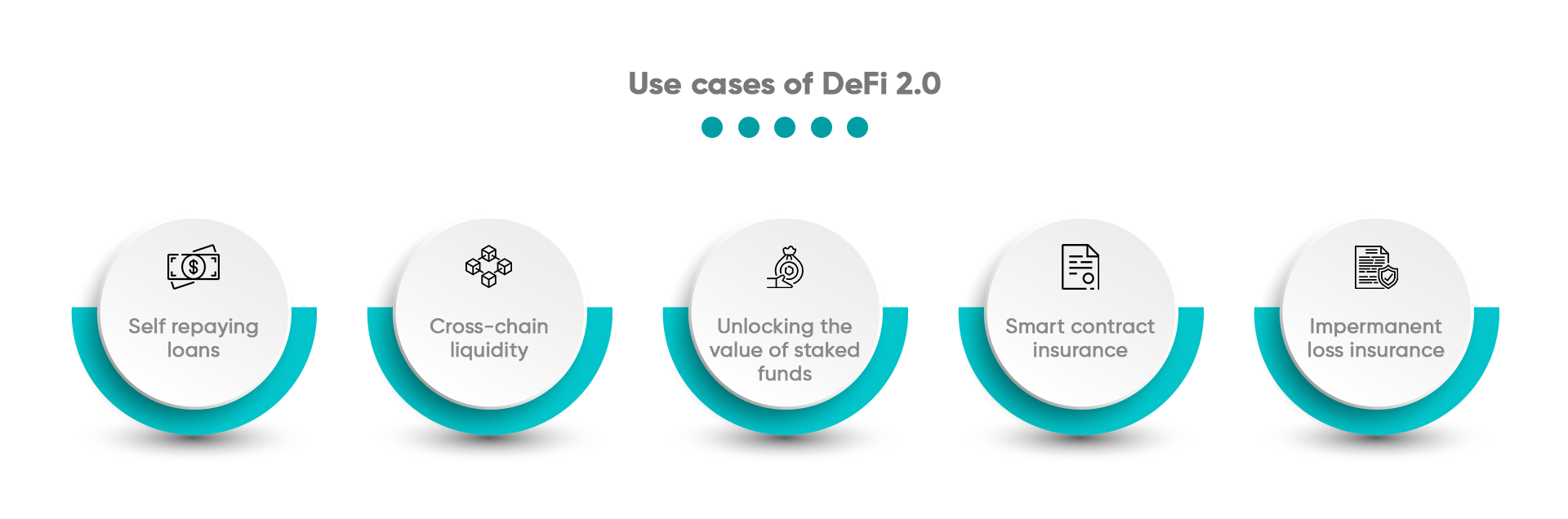

Take a look at some of the most prominent use cases of DeFi 2.0 provided across various blockchain networks.

Some use cases of decentralized finance 2.0 are already in action. You can use liquidity provider tokens and yield farm liquidity provider tokens as collateral for a loan on some platforms. This way, you can benefit from loans while still earning pool rewards. Another variation is by letting your collateral generate your lenders’ interest. This interest pays off the loan without you having to make any additional payments.

Read more: What are DeFi flash loans? How it works?

Decentralized finance 2.0 will enable cross-chain bridges aimed at combating low liquidity. Different blockchains can be connected using layers of smart contracts and liquidity pools. The users can gain access to more assets than just the native. The lack of liquidity of an asset on a chain can be solved by trading between pools on other chains.

You will receive liquidity provider tokens in return when you stake token pair in a liquidity pool, but with decentralized finance 1.0, you can stake the liquidity provider tokens with a yield farm to compound the profits. Decentralized finance 2.0 takes this process further and uses the yield farm liquidity provider tokens as collateral. It has a process similar to MakerDAO(DAI), where the tokens are minted, or a crypto token is taken from a lending protocol. The main idea is that the liquidity provider tokens should have their value unlocked for new opportunities while generating APY.

Read more: DeFi staking platform development checklist

In order to evaluate a project properly, enhanced due diligence needs to be done. However, this can create a massive risk while investing in decentralized finance projects; however, decentralized finance 2.0 makes it possible to get insurance on specific smart contracts. For example, if you are using a yield optimizer and have staked liquidity provider tokens on smart contracts, there are chances of losing all your deposits once the smart contract is compromised. However, an insurance project can guarantee the deposit with the yield farm for a fee. Generally, if the liquidity pool contract is compromised, a payout is not provided, but you can get it if the insurance covers it.

Read more: A checklist for smart contract security

Impermanent loss is a situation where the financial loss occurs when there is a change in the price ratio of the tokens while you invest in a liquidity pool and start liquidity mining. However, decentralized finance is exploring new methods to reduce this risk.

For example, suppose you add one token to a single-sided liquidity provider where there is no need to add a pair, then the protocol will add the native token to the other side of the pair. Thus you can receive the fees and protocol from the swap in the respective pairs. Eventually, the fees can be used to build a business fund to secure the deposit against the effects of impermanent loss. If the payment is less, then protocol can mint new tokens, and if there are excess tokens, they can be stored for later or burned to reduce the supply.

If you are planning to launch a DeFi project, make sure to consult with a reliable DeFi development company to do a feasibility analysis for using the best blockchain platform for your project.

Read more: How to launch a DeFi project?

Even tho it cannot be termed as a risk, the intervention of governments and equivalent authorities in the form of rules and regulations in crypto is daunting. DAO (Decentralised Autonomous Organisation) and governance is a growing trend in decentralied finance 2.0, and we eventually will see how the contradiction of authorities work out.

DeFi 2.0 shares many risks similar to DeFi 1.0, and below given are some of the significant risks involved to keep into account.

Reach out to us today for a no-obligation consultation

The results of decentralized finance 2.0 will educate more people about this paradigm of finance. Decentralized finance 2.0 protocols have simplified front-end designs making it easier for anyone to understand and operate. It bridges the knowledge gap by acknowledging that crypto is still a new concept. Even though integrating centralized systems in DeFi is being debated, decentralized finance 2.0 will encourage integration with centralized trade finanace apps. APIs and oracles can aid in this connection.