By now, you have already heard the term Web3 and why people think it’s the next phase of the evolution of the internet. Obviously, such a drastic change in the architecture of the internet can influence most industries. In this article, we explore how Web3 finance will look like.

Online financial services are essential for any person who wants to actively use the internet. So, with the transition of the internet from Web2 to Web3, will there be drastic changes in the finance sector? What changes can we expect? What will be the factors influencing these changes? What is the state of Web3 finance right now? Let’s dig in and find out.

Web3 is more or like similar to the current Web2 in terms of how it looks and what it offers. The key difference is that Web3 will be decentralized. In this decentralized internet, users will have more control over their online data. Web3 runs on blockchain technology and decentralized protocols to enable users with higher levels of security and transparency. We can expect many changes as the internet transitions from its current state (Web2) to Web3. Some of the key changes are:

In a nutshell, the changes are significant and can have a deep impact on different industries. It can disrupt the way we interact with the internet.

Reach out to our experts today to discuss your project requirement

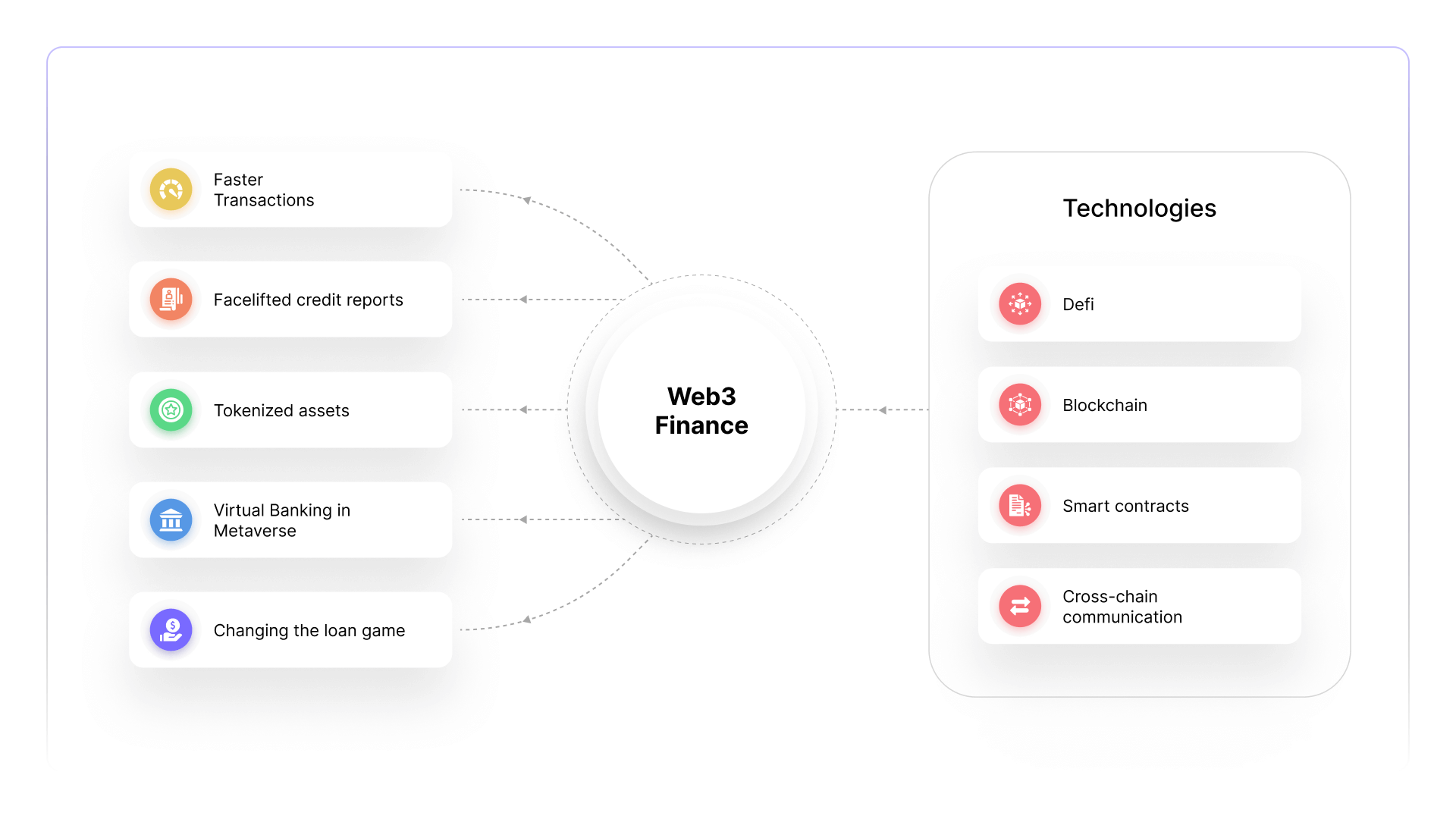

Financial institutions have always taken great initiatives to remain competitive. We can expect the industry to move fast to embrace Web3. Anyways, the change from Web2 to Web3, is it beneficial for financial institutions? That’s a question that will be answered in time. For now, let’s see the key changes we can anticipate in web3 finance.

Instantaneous payments and transactions have never been possible with traditional banking. Transaction settlements, which currently take days, will be completed more quickly in Web3 as it uses P2P transaction settlement using blockchain technology. Whatever the time or day, the transaction delay will change from days to seconds. Transaction and settlement fees can be significantly decreased by making improvements using underlying blockchain and Web3 technologies.

Today, people’s credit reports are created by third-party agencies. When Web3 go mainstream, decentralized apps will be able to create more accurate credit reports of users based on their purchase behavior, spending, and financial discipline. Of course, the user can choose to share the data with a verifier to calculate the credit score. Blockchain-based credit report systems can have a greater impact on financial services. This enables financial institutions to compute credit scores using non-traditional elements.

Several reputable investment firms already use tokenization to represent unique securities, bonds, and other assets. Tokenization enables banks to fractionalise bonds, and other securities are made to facilitate trading. Moreover, self-executing trading is possible with smart contracts, so banks may create an algorithm that reduces risks and increases returns. Physical assets can be tokenized when converted into non-fungible tokens (NFTs). For instance, several financial institutions have previously created NFTs from valuable assets like diamonds.

Web3’s ability to be connected to the Metaverse presents another potential for banking. Users can visit your bank in Metaverse, communicate with virtual employees, and do online transactions in this fashion. Users can contact bank personnel more comfortably and participate from the comfort of their homes thanks to the immersive nature of the Metaverse. Most activities we currently perform offline, such as planning, financial, and virtual portfolio reviews, will also be possible online.

With Web3, P2P loans will become more prominent. Instead of depositing money in bank, people can keep it in their wallets. They can now put cash as liquidity into a smart contract rather than entrusting a corporation with the responsibility of lending them out. The smart contract effectively keeps these assets in escrow, which only releases them when certain requirements are satisfied. Borrowers can apply for loans but can only withdraw money from the smart contract (initially funded by the depositors) after posting enough collateral. Borrowers can still benefit from potential collateral price growth and generate liquidity by taking out loans secured by collateral without triggering a taxable event like selling.

Reach out to our experts today to discuss your project requirement

Financial services may become more affordable with open-source platforms and technology. Here are some new technology innovations Web3 will facilitate in the finance sector. Web3 technologies, such as blockchain and decentralized finance (DeFi) protocols, have the potential to significantly change the financial sector in a number of ways.

DeFi protocols allow anyone with an internet connection to access financial services, regardless of their location or creditworthiness. This could make it easier for people in underserved or unbanked communities to participate in the global economy. As Web3 is decentralized and employs blockchain technology, DeFi plays a far larger role. Inevitably, centralized finance (CeFi) and decentralized finance (DeFi) will merge.

Companies who actively work to close the CeFi–DeFi gap will be at the forefront of financial services innovation. There is no third party in decentralized finance, so the user is solely responsible for their money, how and where they save it, and their transactions.

Banks and financial institutions, which have historically served as platforms of necessity (for credit access, wealth custody, and value transfers), will need to transition into platforms of value. Financial institutions may now use blockchain technologies to improve their customers’ experiences and gain access to a larger pool of new clients who want more transparent and contemporary financial services.

Decentralization is made possible by the intrinsic properties of blockchain technology, which include real-time transparency, immediate value and settlement across borders, data immutability, permissionless access, and more.

Smart contracts can automate many of the processes that are currently carried out manually, which could help to reduce costs and increase the speed of financial transactions. When certain conditions are satisfied, transactions can be carried out automatically by implementing a smart contract. They are tamper-proof, so there is no chance of interference from other sources.

Value transfer between blockchains is made possible by technologies like bridges and swaps, wrapped tokens, hashed time locks, etc. while preserving data security and credibility. Web3 technologies will enable the creation of new types of financial products and services that were previously not possible, such as decentralized exchanges and prediction markets.

Reach out to our experts today to discuss your project requirement

Web3 is emerging; overall, the adoption of web3 technologies in the finance sector is likely to lead to a number of changes that could make financial services more accessible, transparent, and efficient. Businesses should consider adapting to new realities while it is still an idea, with banking being one of the most important areas. It has enabled us to take a different approach to finance and offer a flexible, all-encompassing solution that caters to a wider spectrum of clients. Web3 won’t replace traditional banking, but there is no doubt that steps will be taken toward a larger economy and a more equitable distribution of wealth.