DeFi yield farming is a high-risk high-reward method that emerged in the crypto space that offers very high ROI for crypto investors. The huge return on investments has attracted a lot of trades into yield farming and this space is only expected to go to the moon in the coming years. DeFi stands for “decentralized finance” and acts as a financial ecosystem that is built on top of blockchain technology. It is a collective term for services like investing, borrowing, lending, trading, and other financial services based on decentralized, non-custodial infrastructure.

Read More: Decentralized lending and borrowing on Defi.

In this article, we’ll discuss the core concepts of yield farming and see how to build a yield farming dApp.

In simple terms, DeFi yield farming is an investment process. Suppose you have $1000 worth of crypto with you. You can pledge your crypto asset in a yield farming platform and earn interest for the pledged amount. What makes it interesting is that the crypto you pledge would be used for providing liquidity of assets for traders in the platform. And in the process, you can earn huge profits. Of course, could end up with nothing as well. However, if banks provide you 2-5% interest on your deposits, DeFi yield farming could offer huge interest rates in the range of 100% or even more. As said before, it is a high-risk high-reward investment method.

Reach out to us today and get started!

There are a lot of platforms DeFi protocols available in the market today. Aave, Compound, Curve finance, Synthetics, Uniswap, and Balancer and a few examples. Anyone can deposit their funds in these protocols and earn interest. A yield farmer strategically moves the funds between different protocols or swaps tokens to generate maximum yield. This process is also called crop rotation.

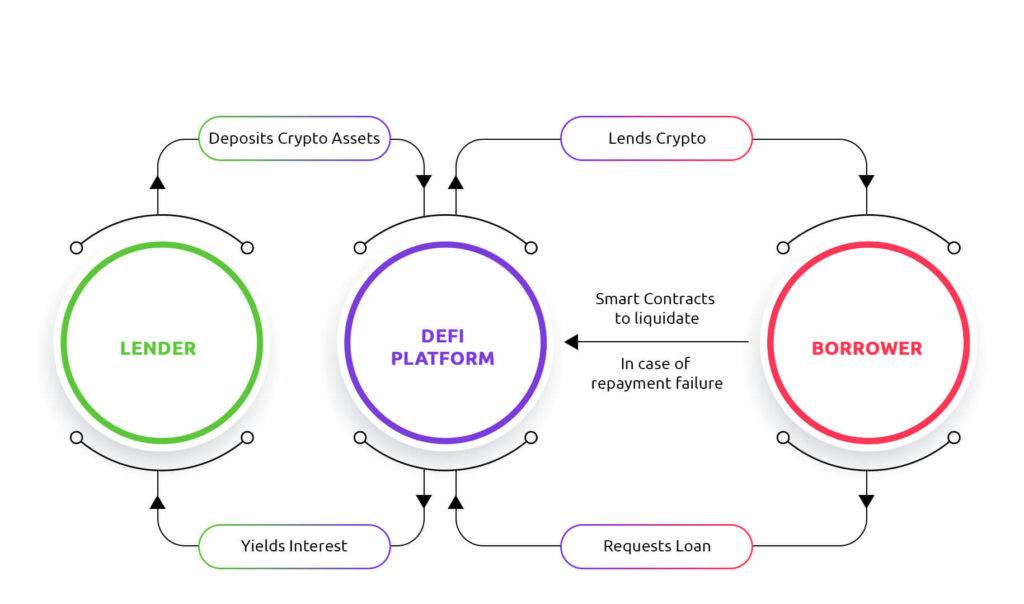

When a yield farmer lends his crypto coins to a DeFi platform, it gives a return based on the DeFi protocol. Shifting the yield to different protocols provides further returns. Based on the strategies that would give the highest yield, farmers switch their yield. To ensure high rewards a farmer must spend time to understand blockchain technologies, DeFi protocols, and the various strategies used to produce a yield.

A DeFi yield farming dApp presents a platform to stake the farmer’s coins and moreover also facilitate the automation of reward payments for the liquidity provider.

Let’s first understand the concept of dApp.

A decentralized app is an application that works on a decentralized network. It uses backend smart contracts for app logic and the blockchain for data storage. Since they are decentralized they are not owned by an individual or a company and can’t be taken down. As is with all blockchain technology it is transparent and automated through the binding of the social contract. The cryptography backbone makes the dApp secure against fraud. Overall presenting a good solution to store transfer and receive tokens.

The strategies involved in yield farming are based on at least one of these: lending, borrowing, supplying capital to liquidating pools and staking liquidity provider tokens.

Farming strategies are volatile though and it’s important that the farmer makes sure that they play to the right protocols and keep themselves updated based on the protocol and the value of the strategy.

Related article on How to launch DeFi project

The high reward of yield farming is accompanied by the high-risk factors involved in the process. Firstly risk of liquidation, a problem when the market value drops down. Then there’s risk based on smart contracts such as bugs on the contract, platform changes, admin key, and systematic risks. Since smart contracts are integral to the trades these risks follow.

Understanding the impact of impermanent loss is also important before jumping into yield farming. Impermanent loss is a temporary loss of funds for a liquidity provider. This is seen in the liquidity pool. When the balance in the pool fluctuates it makes space for arbitrage. This creates a temporary loss. In some cases, the incentives given to the provider by the liquidity pool program can reduce the impact of the loss.

The importance of withdrawing or holding liquidity and a full understanding of the DeFi protocol is paramount to generating a profit for the liquidity provider.

We’ve run through the process of yield farming. And established the possibility to bring in high returns for the tokens you possess. But a core part of the process is understanding Ethereum and its platforms. Creating a dApp helps with receiving, transferring, and storing the tokens.

Reach out to us today and get started!