Launching a Neobank application isn’t as simple as developing an android or ios app and launching it in the app store. To launch a neobank, a banking license to develop regulatory-compliant APIs must be considered. This article will cover the steps to launch a neobank application.

A neobank offers a digital and mobile-first interface for people to access financial services. Setting up Neobank accounts is easier and faster than traditional banks, all the while providing ease and convenience of financial management. The Neobank market is shown to have 47.5 million digital-only bank account holders in the U.S by 2024. Moreover, digital bank penetration in the U.S. is set to increase by 8.9% from 2020 to 2024. It definitely seems like a good time to launch a neobank product. So, before knowing how to launch one, you need to understand the following;

Based on the banking license ownership, Neobanks can be classified into two. Full Stack Neobanks and Front End Focused Neobanks.

Full-stack Neobank products are launched directly by banks as they already have banking licenses to offer financial services. They have control of all front-end and back-end operations, meaning they control the full value chain. These Neobanks also possess their core banking system, or CBS, a back-end system that can process daily banking transactions, accounts, and other financial records.

Full Stack Neobanks can access customer insights from data, which they can utilize to provide more personalized services. Some examples of neobanks operating on this model are N26, Monzo and Atom Bank. On the other hand, front-end-focused neobank depends on larger and established banks for a banking license, achieved through partnerships. They have access to only front-end operations, meaning their control extends to the customer interface. Unlike full-stack neobanks, these use third-party technology to help with CBS.

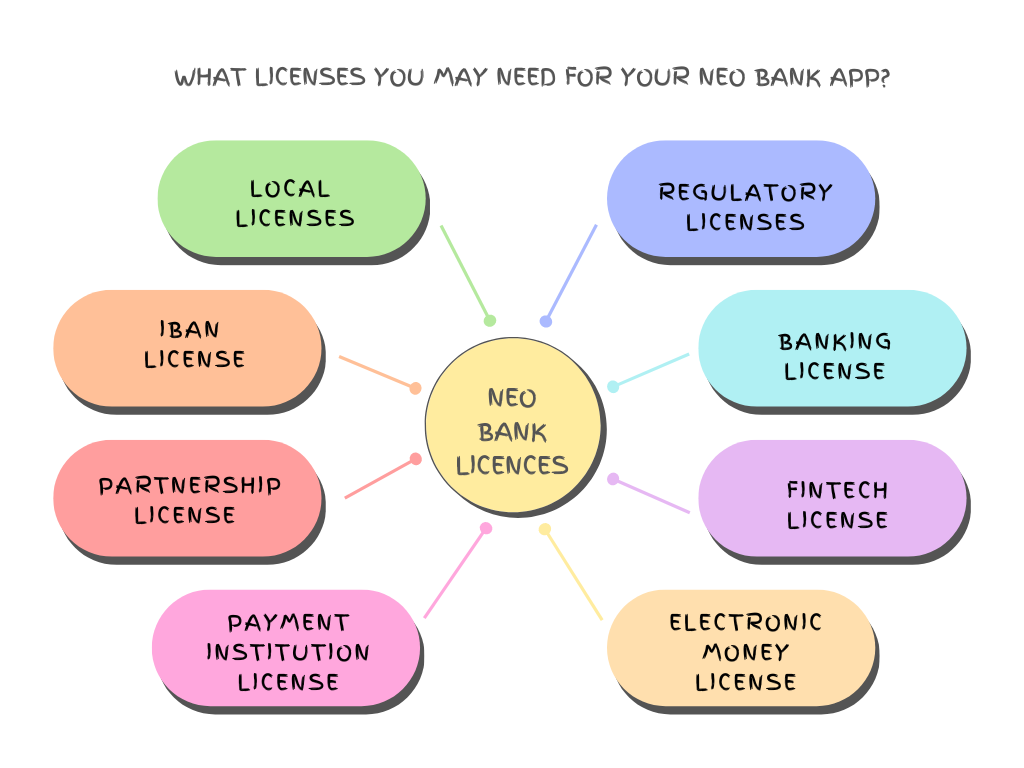

Once the choice is made between the desired neobanking model, the next crucial step is acquiring a banking license or partnering with traditional banks that would allow your app to provide financial services to launch a neobank.

Obtaining a banking license helps ensure compliance and security. For example, you must comply with the PCI DSS if payment card data is stored on your application servers. Obviously, getting a new banking license is very time-consuming and expensive. In the case of a front-end-focused neobank, there is no necessity to be directly licensed. Instead, the app can rely on a trustworthy payment platform with prior PCI DSS compliance. It can also provide banking operation services to your user through your issuing bank. By relying on an established platform, your responsibility can be focused on market research and neobank app design and development. It significantly reduces the time taken for your project to hit the market.

To obtain the banking license and comply with regulatory requirements, the relevant regulatory authority must be identified to start the process. In the case of the United States, this authority rests on the Office of the Comptroller of the Currency (OCC) within the United States Department of the Treasury. The European Banking Authority (EBA) holds authority in Europe. The process is comparatively lengthy and expensive. It involves a series of criteria like meeting capital requirements, providing a pre-determined amount of assets under management, and passing a fit test.

Contact us for a no-obligation consultation

After obtaining a banking license, the application must also comply with other regulations that apply to banks. These include anti-money laundering (AML), countering the financing of terrorism (CFT), know-your-customer (KYC) requirements, and prudential requirements, such as capital requirements and liquidity requirements. Prudential requirements ensure that banks can withstand financial shocks. Hence neobanks are required to design robust risk management systems and a compliance function to ensure that all applicable regulations are met.

Licenses vary based on the scope of permissible activity and business requirements. Open banking regulatory frameworks and licensing requirements differ significantly depending on jurisdiction and type of financial service. They are typically issued by local regulatory bodies such as central banks or financial market supervisors, also known as National Competent Authorities (NCAs), such as the ACPR (France), the FCA (UK), or the BaFin (Germany). The value proposition and business strategy determine the regulatory licensing option chosen.

Banking license

Though a banking license application might be a complicated and expensive alternative for a new digital bank, it enables various banking services. These services can be Foreign exchange transactions, asset management advice and support, and services connected to securities (and other financial products) such as investment, subscription, and payment option management. The application process for a banking license can also be lengthy and take up to 15 months, depending on the jurisdiction.

Fintech license

New financial services licenses introduced as part of this regulatory strategy are designed to fit digital business models, allowing these institutions to provide financial services. These licenses offer comparative ease on regulatory and compliance requirements. These can serve as testing grounds for new business models.

Electronic Money Institution License

An electronic Money License (EML) supports digital payment services such as creating IBANs and issuing and maintaining electronic money (BIN Sponsorship – Credit Card), allowing users to store funds in the account. An EML license allows licensees to give consumers the same banking experience as a complete banking license for everyday payments.

An EMI license can be a cost-effective option for a new digital bank. The application process usually takes 6-12 months, and legal fees range from €75,000-€150,000 for the regulatory license application, with the average total cost to set up the whole organization varying from €1-€2 million.

The Payment Institution License

A payment License (PL) supports various payment services, including cards, mobile apps, transfers, and direct debit transactions. The PL supports cash withdrawals, account deposits, foreign currency transactions, and data processing.

The application process also takes 6 to 12 months. Legal fees range from €20,000 to €125,000 for the regulatory license application (depending on the services you wish to offer). The average cost of setting up the organization ranges from €350,000 to €1.5 million.

Contact us for a no-obligation consultation

Partnership license

Start-ups and other organizations can operate white-label under a licensed financial institution. This allows them to easily operate under a third party until they have reached sufficient scale to obtain their own licensing.

The benefit is that it allows start-ups to cut down the lengthy and complex license application process and operate cost-efficiently before they achieve scale. The third party’s downside is dependence, which means less flexibility, control, and insight into money flows.

Many players (Banking-as-a-Service – BaaS) in the market offer licensed financial services, for example, BIN Sponsorship for credit cards, account management, and loan origination. Many neobanks operate a white-label debit card and e-wallet or offer loans from third-party institutions.

Depending on the commercial agreement and the type of service, these usually require setup fees, a monthly subscription, and/or a per-user fee. The advantage of the agent model is that it allows startups to bypass the lengthy and complex license application process and to operate profitably before reaching scale. It also allows them to quickly evaluate their strategic assets and test how they fit in the market.

Step 1: Define the target audience & value proposition

Defining the niche audiences you would like to target is the first step to launch a neobank or launching any app. This means a fair amount of research to understand your audience demographic and develop a value proposition. And identify the USPs for – why your audience must choose you.

Step 2: Create customer-centric strategies

Leverage technology to create an agile, innovative, customer-centric business strategy. Unique features that work towards the customer’s convenience will add value to your app and help with customer acquisition and retention. Some cool features are:

Other features like Zero joining fee, Zero annual Fee, Zero hidden Charges, Zero documentation, No-cost EMI, Personalized banking services, Educational loans/investments, Seamless budgeting, and Tangible rewards add to the appeal.

Step 3: Build a strong core and backend infrastructure

Building a robust neo

banking app that can manage multiple applications and transactions without lags requires a powerful back-end infrastructure. This can be done by:

1. Developing from scratch or using good quality white label neobank apps

2. Partnering with established banks

3. Partnering with BaaS/API Providers to core and bank end infrastructure

APIs, a card processing app, and back-office tools are also a requirement to create a strong neobank app. APIs will aid in connecting your neobank app with payment gateways or authentication segments. Whereas the card processing app will be responsible for all the card-related transactions, the Back-office tools will manage the neobank’s whole perspective.

Step 4: Focus on experience design

To create personalized experiences, visually appealing app design, easy-to-understand interfaces, and clear call-to-action must be the focus of the design. Enabling frictionless navigation with speed, convenience, security, and seamlessness improves customer experience. Aesthetically pleasing designs provide better customer satisfaction.

Step 5: Manage compliance and security

Set up the Security Office Center (SOC), which will function as a command center and analyze all information in your infrastructure. Additionally, implementing Security Information and Event Management (SIEM) software solutions secures and analyzes every activity. Maintaining access logs provides a record for future reference for the security team. Running a series of regular tests ensures the app’s security and customers’ data.

Step 6: Ease onboarding, engagement, and marketing

Ensuring seamless onboarding for customers can help retain and engage customers throughout their neobanking experience. Marketing efforts must also be focused on the same.

Hiring a team from an experienced mobile app development company can get an app tailor-made to your requirements. The following is the tech stack we recommend for developing neobank solutions.

For IOS Development

For Android Development

Cross-Platform Development

Several of the core features of the Neobanks, be it for full stack neobanks or front-end focused neobanks, are similar and important to deliver a complete experience to the user. The features also ensure that the neobank app is up to standards and can be trusted by the users to handle their finances. In all this, it is important to note that the neobank strategy should be customer-centric, agile, and innovative to bring the best result for your project.

Here are some specific features you can consider to launch a neobank app that can cater to your target audience include:

Neobanking services are diversifying quickly as digitization is maturing all across the world. It is relevant to include services at peak necessity while keeping in mind the legalities and other considerations of neobanks. For example, a bill-sharing system is a great addition for those who want to instantly pay and share the bill with a few. Many such intricate features can rank your neobank app above other digital financial services. Thorough audience research and testing can lead to discovering such gaps and limitations in existing systems, paving the way for you to create a novelty.

You are one click away from our experts