In this article, we will discuss the possibilities of RPA in accounting along with a few tips on how to get started for your business. Since accountancy is a highly process-driven industry, it can greatly benefit from emerging technology like Robotic Process Automation(RPA).

One of the defining characteristics of RPA technology is its ability to automate repetitive tasks. According to a survey conducted by The Economist, 59% of finance & accounting leaders believe RPA will make their business more competitive over the next two years. One of the main reasons behind this widespread adoption of RPA technology is its ability to drive business growth and enhance operational efficiency. If you’d like to brush up the basics of RPA, check out this article that explains – What is RPA and how is it different from AI?

In a world driven by technology, some of us may argue that the accounting process is still quite archaic. When spreadsheets were invented 40 years ago, the technology was a disruptor. However, technology is constantly evolving; and it is safe to say that manual processing of financial data using spreadsheets isn’t the best approach to take in this day and age.

In order to improve the efficiency of the accounting process, businesses have taken a wide variety of approaches. Many of them have started using applications or IT programs that can help humans perform their daily tasks. For example, a typical Accounts Payable (AP) invoice processing workflow would usually involve the following steps- First, the workers would receive a paper invoice or an invoice by e-mail, which is approved manually or over email, printed and then submitted to AP. An AP clerk takes this invoice, reads it, verifies the approvals and extracts the data, inputting it directly into the accounting package – or for large firms that receive hundreds of invoices a day, this may be extracted into a spreadsheet first and then imported into an accounting software. Once it’s in the accounting software, the invoice is ready for payment and processed for payment disbursement based on the payment terms and the frequency of payment batch runs. AP professionals perform these payment runs manually by batching up invoices for payments, checking and removing duplicates and finally disbursing either for physical check prints or electronic funds transfer (EFT) to banks.

Talk to our experts and get free consultation

It is quite obvious that this entire process is time-consuming and monotonous. Although the IT programs being used can help streamline the process, there are massive development costs involved. Moreover, the process hasn’t been fully automated either. This is why businesses need to implement RPA technology. By using RPA bots, businesses can automatically process, extract, input and verify financial data at a fraction of the cost and time.

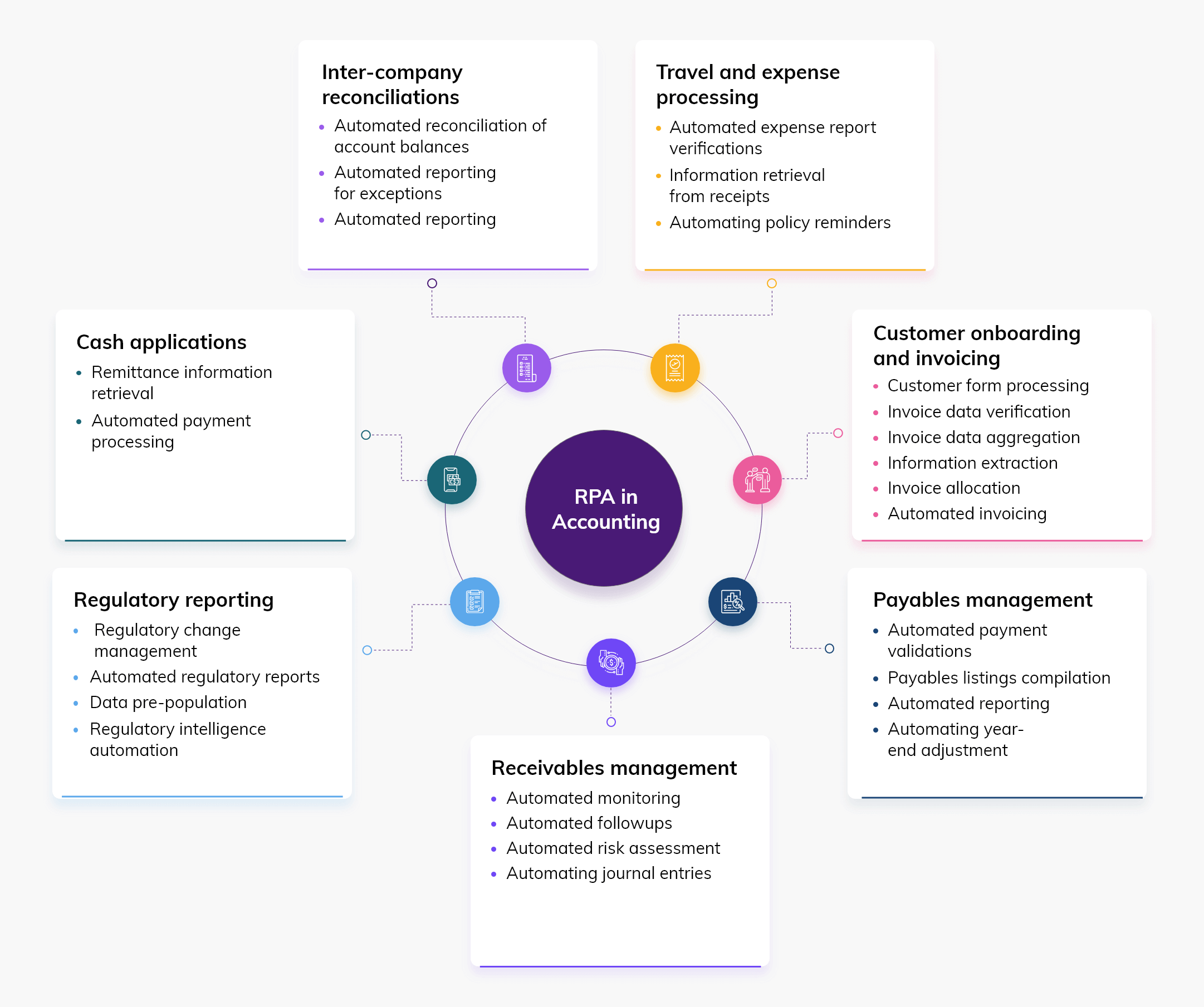

RPA technology can find applications in several aspects of accountancy. Accounting processes, such as Accounts Payable (AP) and Accounts Receivable (AR) involve highly repetitive tasks that can be carried out by RPA bots. A ‘robotic workforce’ has the ability to capture and interpret data whilst responding and communicating with other legacy systems. Meaning that organisations do not experience any disruptions to the processes they already have in place. The diagram below depicts some of the most common use cases of RPA in accounting are as follows:

Information retrieval is a critical process in accounting processes. Using RPA, information retrieval process can be automated to execute a task with 100% accuracy and about 60 times faster. Here is a video explaining the concept.

Talk to our experts and get free consultation

Organizations usually receive invoices from their suppliers in a variety of different formats (e.g. paper, word document, PDF file, etc.) and layouts. Therefore, it is a challenge for the computer software that captures and processes the invoices to retrieve the information correctly.

Through RPA technology, it is possible to train software bots to recognize various different formats of invoices. When they have been shown where to extract the information from an invoice type 3 times, they will be able to process future invoices instantly. This enables quick turnover of documents for approval and leads to invoices being paid faster. In just 6 months enterprises who employ an RPA solution will have already made a positive return on investment. RPA can provide cost savings ranging from 20%–60% of baseline FTE cost

By deploying RPA bots, you will be able to automate a number of processes, leading to much higher levels of productivity. These bots can log into applications, move files and folders, copy and paste data, fill in forms, extract structured and semi-structured data from documents, scrape browsers, and much more. Since the RPA bots will perform all of the low-value, repetitive tasks, your skilled human resources will have much more time to focus on higher value business functions. Additionally, the bots are capable of working tirelessly around the clock. This brings a great deal of added value to the business operations.

The data found in invoices usually follows an unstructured format. This means that it needs to be extracted from different locations before being entered into a company’s system. The manual transfer process of this data is time-consuming and prone to human error. It can also be difficult for more traditional automation softwares to handle. However, if there is any missing data that is essential to completing the invoicing process, the RPA bots can be programmed to search for it and insert it into the correct location of a form. This is yet another way through which RPA technology can help increase productivity levels within an organisation.

RPA technology is completely scalable. The software bots can manage large volumes of data, and answer a massive influx of queries in seconds. By implementing RPA technology, businesses don’t have to worry about increasing labour costs during workload spikes. A robotic workforce can be as large or as small as the employer needs it to be, and additional robots can be deployed quickly for either no extra or minimal cost.

Error reconciliation can hamper the levels of productivity within an Accounts Payable or Accounts Receivable workflow. These errors happen when incorrect data is entered by suppliers on the invoice itself. This happens across a variety of finance and accounting documents, such as invoices and purchase orders. By automating most of this manual and time-consuming work, RPA robots can reduce the amount of oversight and exception handling that is required by employees. This allows organizations to provide a greater level of customer service to other companies. RPA is instrumental in eliminating unnecessary customer (and employee) effort by analyzing, capturing, cross-referencing, and sharing information across channels and platforms without any interruption.

Robotic Process Automation meets all compliance regulations and standards, since every step that is undertaken in a specific process is recorded for historical auditability. This enables tasks to be done in an accurate and effective manner.

Numbers are a key aspect of accounting. Even a small error like a misplaced digit could lead to severe losses. Unfortunately, humans are prone to making mistakes. This can cause serious problems in an organisation. RPA can help with this problem as the bots run according to a set of established rules to deliver higher levels of quality work.

Talk to our experts and get free consultation

Signature forgery is becoming very common in the banking industry. Verifying signature authenticity is a tedious process that is still executed manually in almost every banking institutions today, One of our clients, a prominent bank in Indonesia, wanted to automate this process.

Considering the challenges faced by our client, we developed an AI-powered RPA solution which uses computer vision technology for signature forgery detection. The solution was able to deliver great benefits to the organization. It enabled the bank to reduced the manpower requirement for cheque clearance process in one branch from 12 employees to 2 employees. Facilitating the employees to engage in more productive tasks. Read full case study here: Bank Process Automation Case Study

Now that you have a better idea about RPA technology and the benefits of RPA in accounting, you are probably wondering how to start its implementation in your own organization. Once you have decided on adopting RPA, you can follow these steps to kick start your RPA journey-

Step 1: Opportunity analysis

Accounting operation workflows can vary greatly depending on the organization, and accordingly, the RPA solution requirements change as well. The first thing you need to do is identify a manageable scope of processes that would benefit from RPA technology. Begin looking at the smaller and easier tasks, and then branch out to larger processes. Identifying the right processes for automation is crucial to the success of your project. By assessing processes, businesses are also presented with the chance to reshape its process and attain the maximum benefit from automation.

Criteria for choosing the processes that needs to be automated through RPA-

Common functions in finance and accounting that benefit from RPA include: accounts payable, accounts receivable, accounting & reporting, budgeting & forecasting, expense management, internal audit & compliance, tax, treasury management, and payroll. Accounts payable, with its repetitive work, tends to lend itself better for robotic accounting than a process like budgeting, which requires a lot of human estimation.

Step 2: Determine baseline operations cost to calculate potential profitability

Figure out what your initial operating costs are. This can help you determine the financial benefits and business case for implementing RPA technology. The easiest way to convince shareholders and the C-suite that RPA needs to be implemented is by showing how it can benefit an organization financially. Develop a detailed financial plan that outlines the current business expenditure. Compare this with an estimation of the perceived expenditure after implementing an RPA solution.

Step 3: Analyze the processes that you want to automate

Analyze your workers in the finance department to get a good idea of the RPA improvement opportunities in your organization. After you’ve figured out exactly what your organization’s accounting workflow looks like, use process mapping software like Microsoft Visio to visually represent the processes. Make sure that you document even small and insignificant tasks like screen clicks and copy/pasting. Try to document using BPMN 2.0 stencil, since that is the standard for most IT companies. This format is easiest to hand off to the RPA implementation team when the analysis is complete.

Talk to our experts and get free consultation

Step 4: Decide on an RPA vendor for implementing the solution

Now that you have an idea about your requirements for the RPA solution, it is time to look for a suitable vendor. Choosing the right vendor is the key to a successful RPA project. They will take care of the remaining steps involved in RPA implementation. This includes solution development, pilot testing, bot deployment and maintenance. Although most vendors will provide the first three services, not all of them will provide ongoing maintenance and support. So, make sure to look out for this option when shortlisting potential candidates. Some of the main parameters that you should consider during the shortlisting process include-

The technical expertise of the vendor should be verified along with their organizational credentials. The commitment of a vendor to the RPA domain can be estimated through their previous associations, governance history, and development experience. In the end, it is the ability of the vendor to solve automation issues that can help you in the implementation of Robotic Process Automation successfully.

Accubits’ RPA services has delivered hundreds of RPA solutions for clients all around the world. If you have any questions regarding RPA implementation in your business, don’t hesitate to reach out to us.