The first-ever tweet on Twitter by the CEO Jack Dorsey himself was purchased as an NFT or a digital asset for $2,915,835.47. Following the world’s first tweet auction, a single JPEG was sold for $69 million. NBA entered by selling clips of top shot basketball moments for ginormous amounts, and recently a Lebron James top shot was sold for 280K USD. Not just the popular stuff, but a graphical cat GIF was sold for $600K! You cannot always be as lucky as that cat, as an NFT project requires strategic funding, distribution plans, and community-building exercises. Encompassing all this is an Initial NFT Offering or INO.

The legendary ICO inspires this NFT offering model. ICO (Initial Coin Offering) is a notable model for the same that uses crypto incentives for initial investors. Apart from ICO, other models include Initial Dex Offering (IDO), Game Asset Offering (GAO), and an Initial Exchange Offering (IEO).

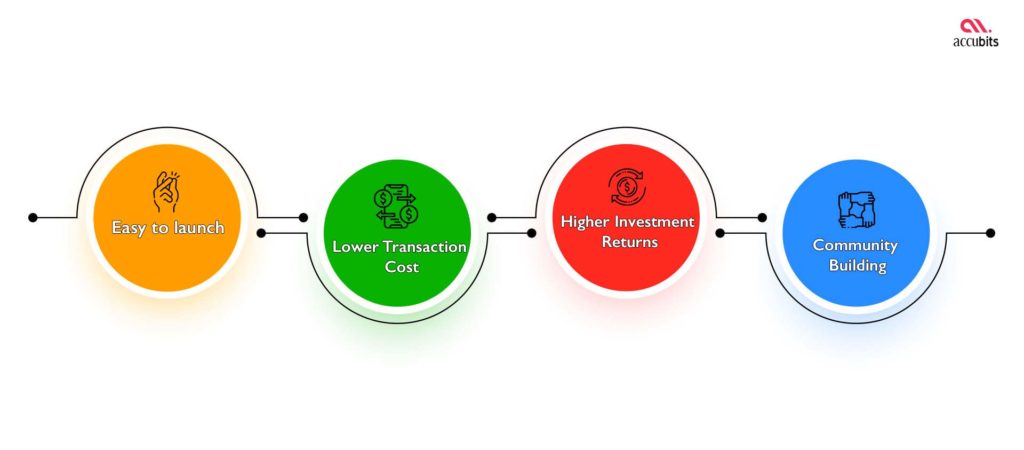

Take a look at the below topics to understand how an INO can help your project.

INO is the short form for Initial Non-Fungible Token Offering. It was recently developed as a crowdfunding technique carried out through decentralized platforms. Non-fungible tokens are sold at the early stages of a project in limited amounts for a stipulated period. This sale raises money for further project development while bringing in committed investors for the NFT asset.

Mimicking the ICO, the Initial NFT Offering, is effective for fundraising in the NFT world. Apart from getting limited edition NFTs or getting their hands on the genesis NFTs (first batch of NFTs of a new project or first-gen NFTs), investors of this offering also get other perks. Some projects offer community voting opportunities to participants, who get a say in the project’s future. A native cryptocurrency backs the NFTs in an offering. The investors or token holders can burn the NFTs to retrieve the cryptocurrency from them, almost like a real-life scratch and win.

Related article: What are Non-fungible tokens or NFTs?

The non-fungible tokens in an offering can be collectible art, music or audio files, or trading cards. New artists and NFT developers face friction in the selling process. With an initial offering, the investor benefit from the intentional supply scarcity of NFTs. When the NFT market develops, there will be incentives for investors.

The INO model is not so different from other existing crypto fundraising models. Other models like ICO (Initial Coin Offering), IEO (Initial Exchange Offering), etc., provide crypto in exchange for investment. The cryptos offered have a use case that the investors can redeem.

Related article: Top 10 Doubts And Questions On NFTs Answered

The NFTs offered in exchange for funds are either collectibles or NFTs with utility. INO model is solely for NFT enthusiasts and its potential investors. Investors who believe in the scalability and growing popularity of NFT companies invest in INO as they carry a wide spectrum of digital assets apart from ease of investment and transferability.

INO model works for your project as described below:

A tweaked version of the model called Initial Staking NFT Offering (ISNO) was developed by a crypto project called Torum. A limited-edition NFT can be staked and offered in an ISNO and also gets the benefit of certain Defi elements. Torum has shaped ISNO to offer more rewards in a ‘stake to unlock’ system. Also, some platforms share the crypto reward between the users and creators.

Related article: Where will NFTs pop up next?

Starting in the non-fungible token world regarding project adoption and investment is difficult. One of the necessary actions is fundraising, as it gives you a leveraging hand on your upcoming journey with NFT. An initial NFT Offering is one of the crowdfunding models that can fund and increase popularity and trust. NFT artists can also understand their audience base and study what they want in art and other NFT content.

Related article: How can sports clubs redefine fan experience with NFTs?

The steps involved in launching an INO are:

Let’s dig deeper and understand what needs to be done in each step.

To launch an Initial Coin Offering is to make sure that your project needs it. Come up with ideas to conduct the. Plan distribution model and the returns users get through it.

The next step is to know your competition. Find out at what rates your competitors are giving out NFTs in the initial offering and bring in a balance. You need not always try to be different than your competition. Accordingly, in some cases, what works for them might work for you too.

Some countries have crypto regulations, which might also affect programs like INO. So it is a prerequisite to be aware of the legal requirements of your country that might affect you.

Create limited edition NFTs or genesis NFTs through a Launchpad. How do you want the limited edition to stand out? What can motivate investors to participate? NFTs’ content and design are important factors motivating people to buy them.

The first thing to have in line after the launch is a solid distribution plan. As NFT offerings are only available in limited numbers, very few can enjoy its benefits. Also, most launches have a first-come, first-served basis for the tokens.

The NFTs put up for offer are the first batch in your collection. Thus decide on a suitable blockchain framework to build. Some popular blockchains that host NFTs are Ethereum, Flow, Binance Smart Chain, Cardano, and Solana.

Creators of the NFT should share the whitepaper, future roadmaps, and others with the users. Transparency is important, especially at this stage, because this will be the first set of customers they get. Thus, build an early community of supporters with interaction and engagement.

Create a launchpad or make use of an existing launchpad platform. Ensure the smart contract is intact and be aware of the procedures in case of a security breach. Finally, you must be able to launch your Initial NFT Offering. This is also a stage where you exhibit complete transparency. The availability of a well-detailed whitepaper considerably captures the attention of potential investors/holders. Lastly, with all the tools and support systems, you can either pick a launchpad or use an existing launchpad to launch. One way to ensure safety is to rely on an external exchange platform that can act as the launchpad.

Reach out to us today to discuss your project

Related article: How record labels can embrace NFTs to add more value to their fans?

Alongside cryptos, NFTs have been gaining attention enough to turn the heads of giant organizations like the NBA. This widespread acceptance of NFT tokens has also put them on the good side of financing for issuance with revolutionary solutions like Initial NFT Offerings. It solves more problems than just fundraising. As such, it helps to introduce an NFT in the market, aiding in better liquidity, risk aversion, faster token listing, and improving user experience.

Reach out to our experts today to discuss your launchpad requirement