Back in 2017, the crypto market was exploding like never before. The hype caused a crypto bubble, and the following year the market crashed by nearly 80%, which is considered one of the biggest even today. Amidst the chaos, ICO struggled to continue as a feasible method to raise capital, and part of the reason was the U.S SEC, which did not particularly support the model. However, based on specific facts, ICO was allowed to be conducted as security offerings and the dual token economy emerged so that crypto projects could comply with the SEC’s requirements.

Companies can raise capital with a security token and have a utility token simultaneously. Read ahead to find out why this model is adopted by numerous projects.

As the name defines, a dual token model has two tokens issued:

In this article, you will learn about the dual token economy, its different formats, its benefits, and a few popular examples of this model.

The dual token economy model is a term used to describe cryptocurrency projects that provide tokens of two sorts. Dual tokens were developed for two main purposes, i.e., to avoid compliance issues with regulators and to divide the ecosystem of the project into two individual purpose-solving tokens for better usability.

Out of the two tokens, one is used as a utility token across the network to perform particular functions or tasks. At the same time, the other one is being projected as a security token to raise finance to run a crypto project. The token performs the role of a security token very well while adhering strictly to the rules governing traditional securities like equities and bonds. The responsibilities of both the tokens vary from project to project.

The primary reason why the cryptocurrency ventures adopt a dual token model is because of the U.S. Securities and Exchange Commission. The SEC framework has properly classified bonds, equities, securities, and stocks under specific categories, but they have not yet classified the crypto assets, making it hard for crypto ventures.

For a token to be treated as a security, the crypto project needs to ensure that its tokens offer actual benefit and revenue to its holders and are entirely decentralized under US law. SEC will treat those tokens as securities only when these criteria are met.

Related article: How to digitize securities, assets, and capital market Instruments using blockchain

Before cryptocurrency, people’s security assets were currencies, commodities, and stocks. These securities blur the differences between crypto assets and tokens in general. With the old security framework, it becomes difficult to classify them precisely.

The Securities and Exchange Commission has been woolly on treating and classifying crypto assets and tokens. The “Framework for ‘Investment Contract’ Analysis of Digital Assets” was released in April 2019 by SEC, where comprehensive guidance is provided on which digital tokens can be categorized under the securities category. This framework was a great release for the blockchain projects, as they can now avoid breaching the law.

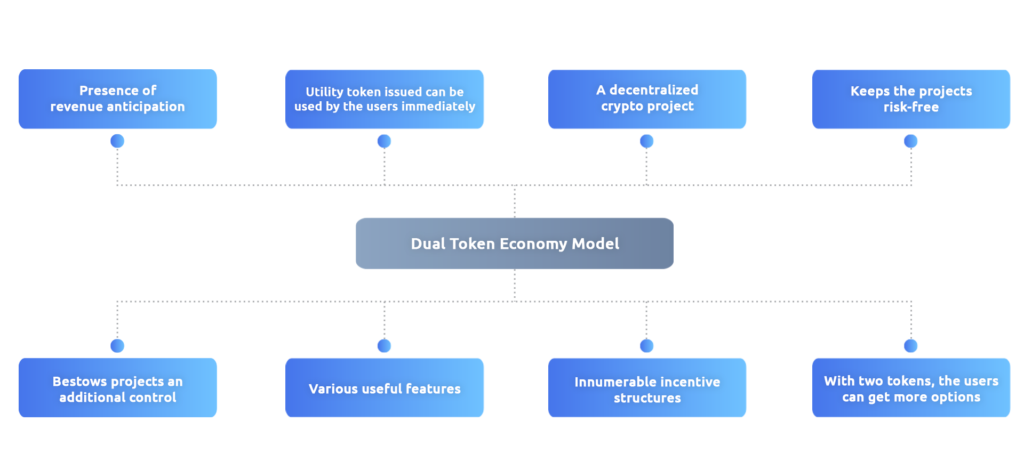

The dual token model is indeed very different from other token economies because of the following traits it inhibits:

If you plan to launch a crypto token that uses the dual token economy model, make sure to choose the best token launch platform that can help you take your cryptocurrency project to the market in the shortest time possible.

The crypto market started spreading its wings in 2017, and this dual token model was the chief contributor. Everyone believed that these new tokens’ value might skyrocket; hence, everyone wanted to have some holdings of these tokens.

The dual token framework works by segregating the token into two sections – Security tokens and Utility tokens.

Only accredited investors are given the liability to access the tokens for security purposes. Investors can use this token to raise capital to run a blockchain project while adhering rigorously to the government compliances and regulations meant for traditional securities like bonds and stocks.

Only accredited investors are given the liability to access the tokens for security purposes. Investors can use this token to raise capital to run a blockchain project while adhering rigorously to the government compliances and regulations meant for traditional securities like bonds and stocks.

This token is used only within the platform or network. With this token, investors cannot raise funds as it is used to serve specific purposes based on the platform’s architecture.

Related article: Understanding ICO token models. How to choose the best for your project?

The dual token model has three formats:

Let us continue reading to know about all three formats in detail.

Under this format, an ICO is bundled with both the utility token and the security token. Such an ICO is termed a packaged ICO. As we know, people invest only on that platform from where they can add up some extra revenue.

The utility token has been used as a bonus to entice and encourage people to invest in the security token. Say, for example, the person who will buy security tokens will be given a predetermined number of free utility tokens in the form of a bonus.

Under this particular format, a single token – a security token is issued by the project to ICO. A utility token is not issued simultaneously with the security token to raise funds. At the very least, a utility token is not used to increase purchases of the security token.

Both the tokens are issued separately; this model has no promotional mechanism to encourage potential investors via utility token rewards. Here, the security tokens are issued first to obtain and secure funding. Once the project starts, then the utility tokens are issued.

Although ICOs always back a dual-token project here, the scenario is slightly different. A project need not be based on ICO as it uses dual models. In this non-ICO dual-token format, the security tokens and the ICO securities regulatory compliance requirements are not directly related. Thus, the project might not term these tokens “security tokens.” Both tokens issued by the project may play a slightly different role.

Maker DAO is the best example that falls under this format. It is the largest and the most popular dual-token DeFi (Distributed Finance) project worldwide.

The first token of Maker: The stablecoin of Maker DAO – DAI, is used for providing loans to the platform’s users. Using ETH, the collateralization of the loans is done. The loan is paid by the user inside a “Vault” present on the system. DAI maintains a peg of 1:1 to the US currency. The second token of Maker – MKR, is issued for giving the governance rights to its holders on the network or platform.

Contact us for a no-obligation consultation

Knowing about the dual token model in detail and its format, it is now the turn to throw some light on its benefits.

Related article: How to create and launch a Stablecoin?

Though there are many examples of dual token economies, here we will discuss the most famous ones.

Though there are many popular dual token model examples, the most popular one is MakerDAO which has DAI and MKR tokens. The crypto market experienced a boom in 2017 when many crypto tokens were sold. Amongst those tokens, THE MKR token, an essential token for the system’s design, occurred early.

MakerDAO used MKR tokens to maintain the price stability and govern the DAI stablecoin. If the value of DAI is equivalent to 1 USD, no MKR token is created, and the MKR token holder profits from a smaller supply of MKR. On the other hand, if the difference between the DAI’s value and 1 USD is very much, then MKR is created. In such a scenario, the MKR token holders have to trade in with an inflated supply of MKR. The holders of MKR hold the right to vote on platform changes.

Anchor is a decentralized protocol. It combines two tokens to create a stablecoin. The MMU – Monetary Measurement Unit, plays the role of a steady financial index reflecting the long-term economic development, and their stable token’s value is tethered to it. DAI of MakerDAO is pegged to the US currency, while Anchor’s ANCT is tethered to the MMU.

The Anchor system’s stablecoin is ANCT (Anchor Tokens). Anchor offers its users amazing perks, i.e., price stability for the long term, along with protection from unexpected inflation by hedging against market volatility.

Filmio is a decentralized crowdfunding platform for filmmaking projects, including two tokens, Anchor and MakerDAO. The security tokens of Filmio are termed FILM tokens, which only accredited investors can purchase.

Just like a stockholder in a particular company is allocated to company dividends, in the same manner, the FILM holders hold the right to claim income from the profit of Filmio projects.

On joining the network, the utility tokens called FAN tokens are issued to the joiners as a reward. Investors can utilize these utility tokens to engage with other token holders and decide on projects.

Related article: How fan tokens are redefining team loyalty and fan experience

Since 2017, investors have noticed a significant growth in the dual token model. The utility token and the security token model have gained immense popularity, backed by ICO securities regulations.

The dual token model is perfect for all stablecoin projects. A utility token can be used to enable general transactions and may see volatility on a user-demand basis. In contrast, the second token is used as a stablecoin pegged to the government currency.

In the coming period, digital payments will be used widely all over the world, ultimately leading to the growth of stablecoin projects. Furthermore, this would result in high demand for the dual token model.

Contact us for a no-obligation consultation with our experts